SMBs: An underserved market and an untapped opportunity

Small and Medium Businesses (SMBs) make up an essential value pool for the banking and financial services industry, accounting for more than 90% of all companies and more than 50% of jobs worldwide1. According to a 2019 report by McKinsey, SMBs account for a whopping USD 850 billion of annual revenue for banks globally, with an expected growth rate of 7% annually over the next seven years2. Even after the severe impact of the pandemic, the annual SMB revenue opportunity for banks would be very close to the trillion-dollar mark by now.

Despite being such an important value pool, SMBs have remained an underserved market for their business banking needs. The finance gap for formal SMBs in emerging markets is estimated to be USD 5 trillion. Taking into account informal SMBs and those from vulnerable and underserved groups, there is an additional financing gap of USD 2.7 trillion for the sector.

SMBs, owing to their low and volatile turnover, struggle to get priority from most traditional banks. The challenge for banks is balancing the cost to serve an SMB customer against the uncertain ticket size and potential risk. Banks have also found it cumbersome to risk assess SMBs efficiently due to lack of documentation, inability to front collateral, or offer structured insight into their financial standing. As a result, SMBs find themselves in a ‘no-banks’-land’ stranded between large corporates and retail customers, inundated with one-size-fits-all products and services that don’t meet their business-critical needs.

The last two years have seen significant shifts in this challenging equation. The COVID-19 pandemic has had a devastating impact on SMBs but has also accelerated their adoption of digital tools and channels across sales, operations, finance, and accounting. This digital adoption offers banks an unprecedented opportunity to assess SMBs’ creditworthiness cost-effectively. Moreover, access to deeper data like sales pipeline, orders, procurements, etc., makes it possible for banks to adopt alternative risk and needs assessment models and innovate more suitable banking and beyond banking products to grow the overall value of the relationship.

All of this, however, requires banks to reboot their current approach to digital banking. Simply enabling digital access to existing products is not solving the challenges of traditional banking for SMBs, which are high cost of acquisition and serving, out-of-date risk and needs assessment, and overall low product fit. This friction in traditional banking offerings and SMB needs has created whitespaces for fintechs, who are rapidly capturing the minds and wallets of entrepreneurs desperate to solve their problems.

With this blog, we present a holistic understanding of how the SMB landscape has evolved over the last two years, fintech innovations that rise and meet SMB needs, and what banks can do to accelerate the reboot of their SMB business banking offerings.

Evolution of the SMB landscape

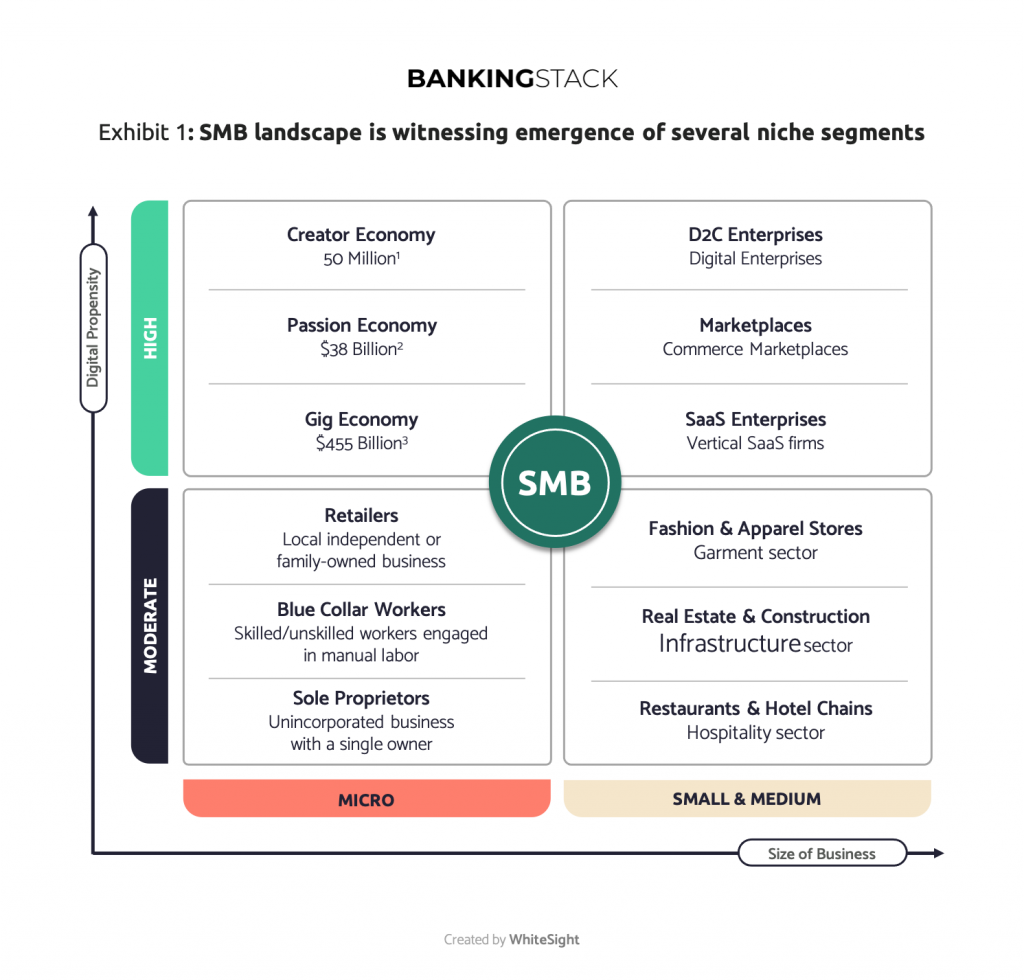

SMB is an incredibly diverse segment with variations across numerous parameters such as size, industry vertical, life stage, ambitions, digital maturity, and much more. The segment has grown even more complex with the addition of creator and gig economy participants in the mix who are like the SMB counterparts of GenZ in the retail segment. They are digital natives and have quite a unique set of expectations from financial service providers. The new market for creators has emerged as a result of the digital tools that allow creative expressions, personal branding, remote work, and global distribution.

Exhibit 1 maps the rise of digital-era business models that have created several other new forms of niche segments in the SMB sector, such as highly specialised freelancers, international gig workers, direct-to-consumer e-commerce sellers, passion economy creators (using new digital platforms like Substack, Patreon, Teachable, or Medium), niche marketplaces, and specialised vertical software-as-a-service (SaaS) enterprises.

The emergence of new digital-native sub-segments and rapid digitalisation of existing ones in the SMB landscape has opened up important value pools for financial institutions (FIs). These sub-segments have witnessed skyrocketing growth rates, and their widespread digital footprints allow FIs to optimise the cost-to-serve the clients.

Below is a snapshot of these emerging and attractive value pools:

- The creator and passion economies are emerging as significant value pools with attractive growth rates. The passion economy, in which people monetise their skills and hobbies to earn income, is worth more than USD 38 billion globally, according to new research by Disciple Media4. According to SignalFire, more than 50 million people worldwide consider themselves creators5. It has become one of the fastest-growing types of small business. According to Mastercard, the global gig economy will be worth USD 455 billion by 2023 and witness a CAGR of 17.4%6.

- The last 5-6 years have seen a wide variety of startups emerge across the globe. These startups have unique business models such as direct to Consumer (D2C) businesses, marketplaces, and vertical SaaS enterprises. These new business models act as unique levers for the exponential growth of the segment. The United States leads the chart with over 70000 startups, followed by India and the UK, which have over 13000 and 6000 startups, respectively7. These hyper-growth startup segments have unique financial needs, and they look for automated and integrated solutions to optimise their time for business growth activities.

- The pandemic has been a game-changer for the digitalisation of the SMB segment. As per OECD, business surveys worldwide indicate that up to 70% of SMBs have intensified their use of digital technologies due to COVID-198. This digitalisation is multi-faceted and involves using and applying a broad range of technologies for different purposes such as marketing, administration, invoicing, accounting, expense management, etc.

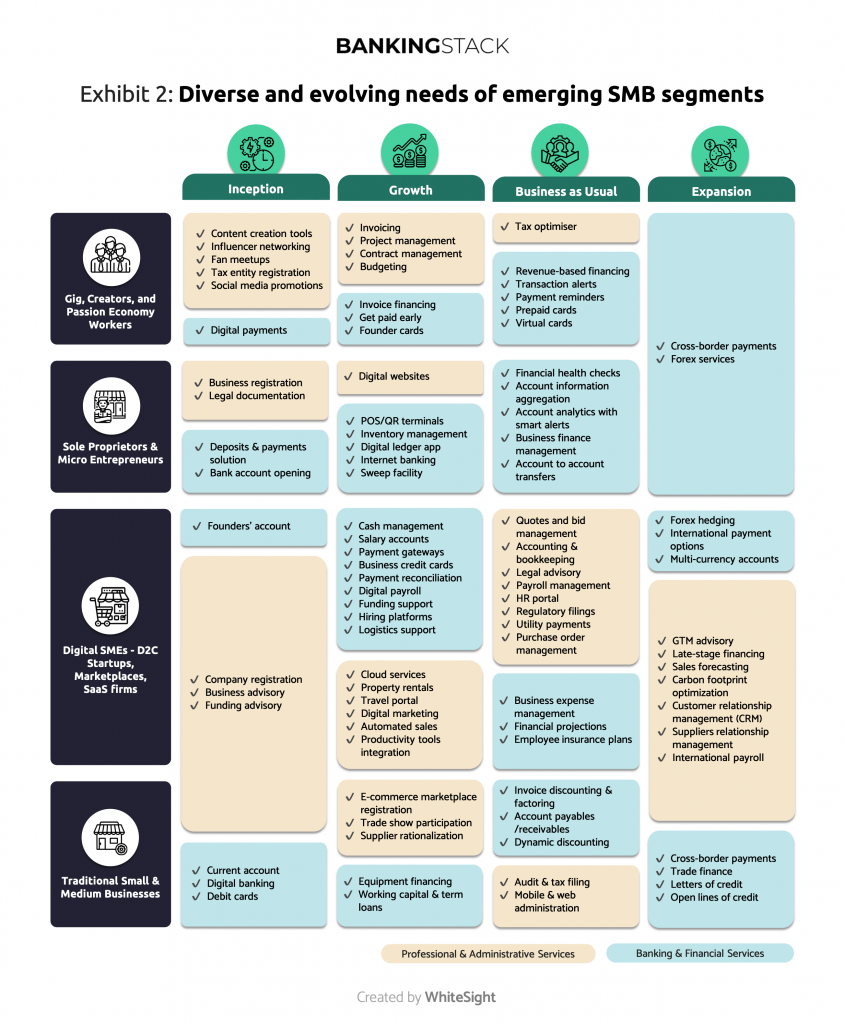

Evolving SMB banking needs

For banks to compete meaningfully for these emerging segments, digital acquisition, end-to-end digital customer journeys, and a segment-sensitive product fit are critical. Importantly, banks need to map how newer products and services integrate traditional banking offerings with ‘run-the-business’ and ‘grow-the-business’ value adds for these customers.

A survey of small business owners conducted by McKinsey categorised business activities of SMBs across two categories: core activities and administrative activities.

Core activities are ‘grow-the-business’ activities that contribute directly to the firm’s growth and profits, such as approaching prospective clients, managing the delivery of products and services, and maintaining client relationships for cross-selling and up-selling opportunities.

Administrative or ‘run-the-business’ activities include contract drafting, invoicing, accounting and bookkeeping, payroll management, payables and receivables tracking, financing, tax planning, and managing payments and bank accounts. These are all essential tasks for the smooth operation of a firm but do not directly generate revenues and are seen as overheads.

The research survey from McKinsey also highlighted that SMBs spend up to 74% of their time on administrative activities. Entrepreneurs and business owners across SMB sub-segments want to maximise the time spent on core activities and minimise the time spent on administration, which innovative service providers exploit:

- Fintechs and digital platforms have recognised the need and offer automation tools and seamless ecosystem integrations that allow business owners to significantly reduce their run-the-business effort.

- Neobanks have taken this a step further and offer all-in-one ‘business banking accounts’ that integrate fully-digital current accounts with bookkeeping, payments, collections, expense management, automated reconciliation, and more.

- Neobanks allow SMBs to gain greater control over their business expenses with integrated cards and expense management suites, while seamless procure-to-pay and order-to-book workflows integrated with their bank accounts make cash flow management virtually painless.

- Neobanks also allow SMBs to plug their accounting software, e-commerce marketplaces, logistics platforms and more, directly into their neobanking accounts, further easing the flow of information and action across banking, finance, operations, and delivery.

Apart from emerging business models, banks should also look at the needs of SMBs based on their life stages. Until now, banks have shied away from a very early stage or thin-filed businesses due to the same concerns of creditworthiness and value. However, this is through the lens of traditional banking products, which, by design, are more suited for better established going concerns.

As seen in Exhibit 2, fintechs are targeting the critical financial and non-financial needs of emerging SMB segments during different life stages, entrenching themselves as service providers of choice before banks.

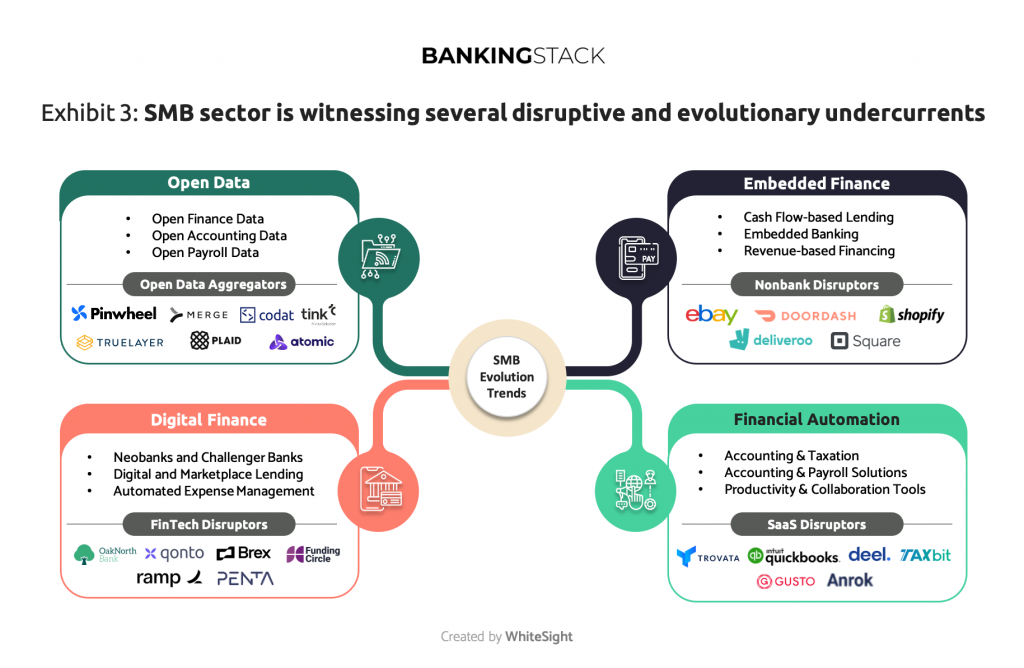

Fintech disruption in SMB Banking

The underserved SMB segment offers massive whitespace for a range of new entrants from fintechs, digital platforms, and business tools to innovate for the seamless and contextual distribution of financial products and services. Enabling technologies such as cloud computing, microservices architectures, interoperable APIs, data analytics, artificial intelligence, machine learning, etc., empower FIs to better understand customers, orchestrate personalised experiences, and enhance operational efficiencies to improve risk management practices to reimagine banking for SMBs.

Exhibit 3 analyses some of the key areas which have facilitated disruptive value propositions being launched by fintechs, non-banks, and digital platforms to meet the needs of the SMBs.

Open Data for SMBs

Regulatory and market initiatives around Open Finance have unlocked new opportunities for consent-based data sharing among financial institutions and third-party providers (TPPs). In the realm of Open Finance, the TPPs can access granular and high-provenance data from several applications used by SMBs such as banking, accounting, ERP, invoicing, payroll, etc. This data sharing enables SMBs to primarily benefit from two categories of use-cases:

- Improved operational efficiency: Sharing business data between internal tools such as tax filing systems, invoicing systems, cash forecasting applications, and payroll software allow SMBs to automate several run-the-business activities and reduce operational overheads.

- Gain access to personalised financial services: Consent-based data sharing with TPPs such as fintechs, neobanks, expense management platforms, insurance providers, etc., allow SMBs to access better financial products and services, improve approval rates, and reduce approval, onboarding, and disbursement times.

Open Banking data aggregators such as Plaid, Tink, Truelayer, etc., have established themselves as a critical part of the ecosystem to enable banking data sharing. In recent times, several data aggregation platforms, such as Codat, Merge, Pinwheel, Atomic, etc., have raised massive funding rounds to develop the data-sharing infrastructure to facilitate data sharing beyond financial data, such as commercial data, logistics data, social data, accounting data, sales data, inventory data, payroll data, etc.

Embedded finance for SMBs

In the last few years, more and more non-financial players have started to offer integrated financial services such as bank accounts, digital wallets, corporate cards, payments, lending, transaction banking, and investment products alongside their core offerings to SMBs. Some of these non-financial digital platforms, such as Deliveroo, DoorDash, UberEats, and Shopify, use embedded finance as a strategic lever to foster a unique relationship with customers and increase their lifetime value by reducing their run-the-business overheads.

An Accenture analysis forecasts that embedded banking for SMBs could capture up to 26% of global SMB banking revenue by 202510. The survey also predicts that 41% of SMBs would be interested in using banking services from a digital service provider, and 47% of them would be willing to pay the same or more for embedded finance compared to traditional banks.

Embedded finance has emerged as a key phenomenon for SMBs worldwide, allowing them to access contextual financing options on the business platforms they use for their day-to-day business, such as B2B e-commerce platforms, procurement finance platforms, digital marketplaces, etc.

Digital finance for SMBs

As per a recent Oliver Wyman survey, 75% of SMBs have little to no loyalty to existing banking relationships11. They are quite price-sensitive and will switch if lower-cost options provide a similar level of service. SMBs also welcome self-service digital channels, with more than 90% indicating they are comfortable with them. Another McKinsey analysis found that digital SMB banks enjoy up to 70% lower cost-to-serve SMBs than their traditional peers12.

Several digital-only banking initiatives from FinTechs and traditional banks, popularly known as neobanks, have emerged to leverage this cost-to-serve advantage to attract SMBs with business-related value adds. Neobanks offer all-in-one ‘business banking accounts’ that integrate fully-digital current accounts with bookkeeping, payments, collections, integrated cards, expense management, invoicing, automated reconciliation, and more. Several SMB-focused neobanks have seen significant traction in the last 18 months. In January 2022, Qonto – a challenger bank focused on business bank accounts, raised a $552 million Series D funding round and reached a valuation of $5 billion. Other SMB-focused challenger banks such as Lili, Novo, and Rho have raised massive funding rounds in the last 12 months to accelerate their product development and market expansion initiatives.

Financial automation for SMBs

As per a Deloitte survey, 85% of SMBs who use financial automation tools in their day-to-day operations confirmed that they had helped their business in some way. The widespread adoption of financial automation tools by SMBs has unlocked new value-generating opportunities, such as:

- Development of fintech solutions/marketplaces integrating and automating workflows across banking, finance, and operations

- Bundling of these solutions with digital banking offerings as value-added services for SMBs

- Development of new risk assessment models based on access to alternate data points

In 2022, corporate expense management firm Ramp raised $550M in debt from Citibank and Goldman Sachs, among others, and hit an $8.1B valuation. Several other business expense management platforms, such as Brex, Jeeves, DiviPay, Yokoy, and Soldo – have raised significant funding to address the needs of the SMB sector. Karat, a creator-focused credit card that advances fee-free credit on sponsorship payments, raised $26 million in Series A funding in 2021. Willa Pay, another creator’s economy platform, allows users to create custom invoices with payment links and details and offers fast access to payments.

Response from incumbent banks

While incumbent banks face intense pressure from fintechs, big-techs, and digital platforms, they also have an edge in customer trust, resources, and collaborative ways to rapidly launch innovative financial products for SMB customers. Below is a snapshot of select initiatives from incumbent banks catering to the SMB segment:

- In 2018, NatWest launched an SMB-focused digital bank called Mettle to compete with digital challengers such as Starling and Tide. Mettle offered business accounts with digital onboarding to sole traders and small companies, as well as tools for cash flow forecasting, integrated invoicing, expense management, and custom integrations with accounting platforms.

- In 2019, Emirates NBD, a leading banking group in the Middle East, launched E20 – a digital business bank. E20 has focused on serving startups, sole proprietors, freelancers, gig economy workers, and small-to-medium-sized companies with a business bank account and allowing them to carry out their day-to-day banking requirements easily through a mobile app. E20 also enables integrated access to various cash flow management and supply chain management services.

- In April 2021, Pacific Western Bank partnered with Extend, a digital payment infrastructure FinTech, to launch a virtual commercial credit card solution for SMBs. The solution allows the bank’s clients to generate virtual cards on-demand through the bank’s virtual card app that can easily be utilised for simple, secure payments. SMBs can instantly empower their employees, contractors, and vendors to use virtual cards for single or recurring purchases without waiting for physical cards. SMBs can also establish controls on each virtual card and set recurring cards for ongoing vendor payments.

- In April 2021, Silicon Valley Bank (SVB) partnered with Teampay, a spend management services provider, to offer seamless spend management controls to SVB business cardholders. Teampay’s spend management platform integrates with the SVB’s Innovators Card and unlocks proactive control capabilities and real-time visibility to clients. The partnership enables transactions to be automatically reconciled in the SMB customer’s ERP, giving the finance team real-time visibility into business expenses.

- In May 2021, Marcus by Goldman Sachs partnered with C2FO, a digital platform for working capital, to provide financing to SMBs. The partnership gave unsecured financing to eligible businesses that use C2FO in the United States by enabling a fast and efficient way for the clients to access working capital.

SMB banking reimagined with BANKINGSTACK

In 2018, Accenture Research found that only 1 in 10 banks were committed to digital transformation; 4 in 10 were trying to transform but had no cohesive strategy, and 5 out of 10 weren’t making any progress14. Meanwhile, an IDC analysis estimates that over 70% of siloed digital transformation initiatives do not reach their goals15. Of the $1.3 trillion spent on digital transformation in 2018, it was estimated that more than $900 billion went to waste16.

Recent research from BDO, a professional services firm in the US, found that although 97% of middle-market financial institutions have a digital strategy in place or development, only 30% are currently implementing that strategy17. This highlights the challenges of embarking on digital transformation journeys, which may be expensive and risky.

Banks no longer have to view SMB customers as complex and costly to serve. The pandemic has accelerated significant digital adoption in the sector. Recent advances in digital technologies and innovative business models present an unprecedented opportunity, thanks to the data generated by SMBs’ digital footprint.

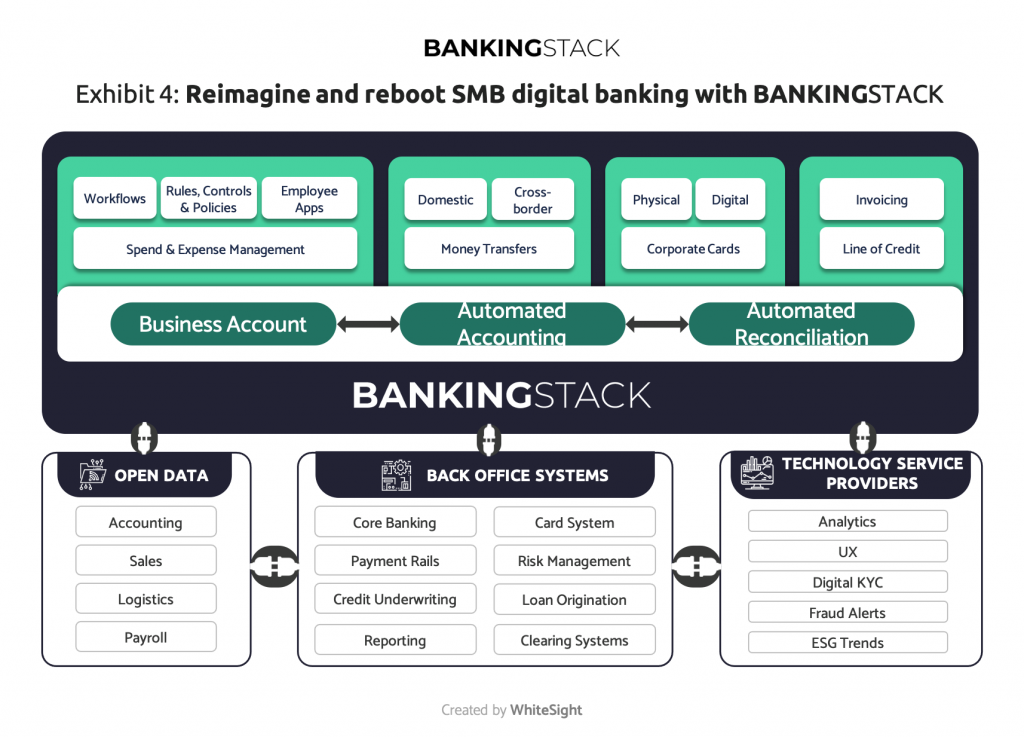

BANKINGSTACK allows banks to prioritise and accelerate their SMB banking efforts by enabling them to create custom products and services for the sector by allowing API-based integrations with their back-office systems, open data aggregation platforms, and other third-party technology service providers. The API-led architecture also allows banks to enable cost-effective ways to serve SMB customers through suitable channels as per the need of the SMB customers. Scalable distribution-led partnerships can also be unlocked by enabling integrations with fintechs, big-techs, and digital platforms. This ecosystem approach to business model transformation allows banks to experiment with emerging banking-as-a-service and embedded finance propositions and unlock new revenue streams in the form of tech-stack monetisation and earning commission revenues from the ecosystem partners.

References:

- World Bank SME Finance: Development news, research, data

- How banks can use ecosystems to win in the SME market | McKinsey

- Promoting Digital and Innovative SME Financing

- Welcome To The Passion Economy | Forbes

- What is the creator economy? Influencer tools and trends | SignalFire

- The Global Gig Economy: Capitalising on a ~$500B Opportunity | Mastercard

- Startup Statistics (2022): 35 Facts and Trends You Must Know

- The Digital Transformation of SMEs – OECD

- How banks can use ecosystems to win in the SME market | McKinsey

- Embedded Finance for SMEs: Banks and Digital Platforms | Accenture

- Reinventing The SME Digital Experience | Oliver Wyman

- How banks can use ecosystems to win in the SME market | McKinsey

- The performance of Small and Medium Sized Businesses in a digital world | Deloitte

- Only Half of Banks Globally Are Making Significant Advancements in Digital Transformation, Resulting in Lower Market Valuations, Accenture Report Finds

- Digital Disruptors Leverage Strategic Governance and Vendor Sourcing and Management Practices: Survey Findings | IDC

- Banking on digitalisation: A transformation journey enabled by technology, powered by humans | PwC

- 2021 Financial Services Digital Transformation Survey | BDO