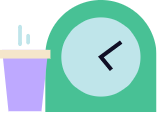

The global revenue based financing market size was valued at USD 901.41 million in 2019 and is projected to reach USD 42 billion by 2027, growing at a CAGR of 61.8%.

There is a no-man’s land in lending for businesses that may earn steady revenue but are not yet profitable, nor have the kind of tangible collateral (real estate, machinery) that traditional loans require. With rising pressure on profitability across industries, as well as emergence of digital-first business models such as Direct to Consumer (D2C) businesses, marketplaces, and vertical SaaS enterprises, a large section of small and medium enterprises (SMEs) find themselves in this no-man’s land, struggling for growth capital just as they are ready to scale.

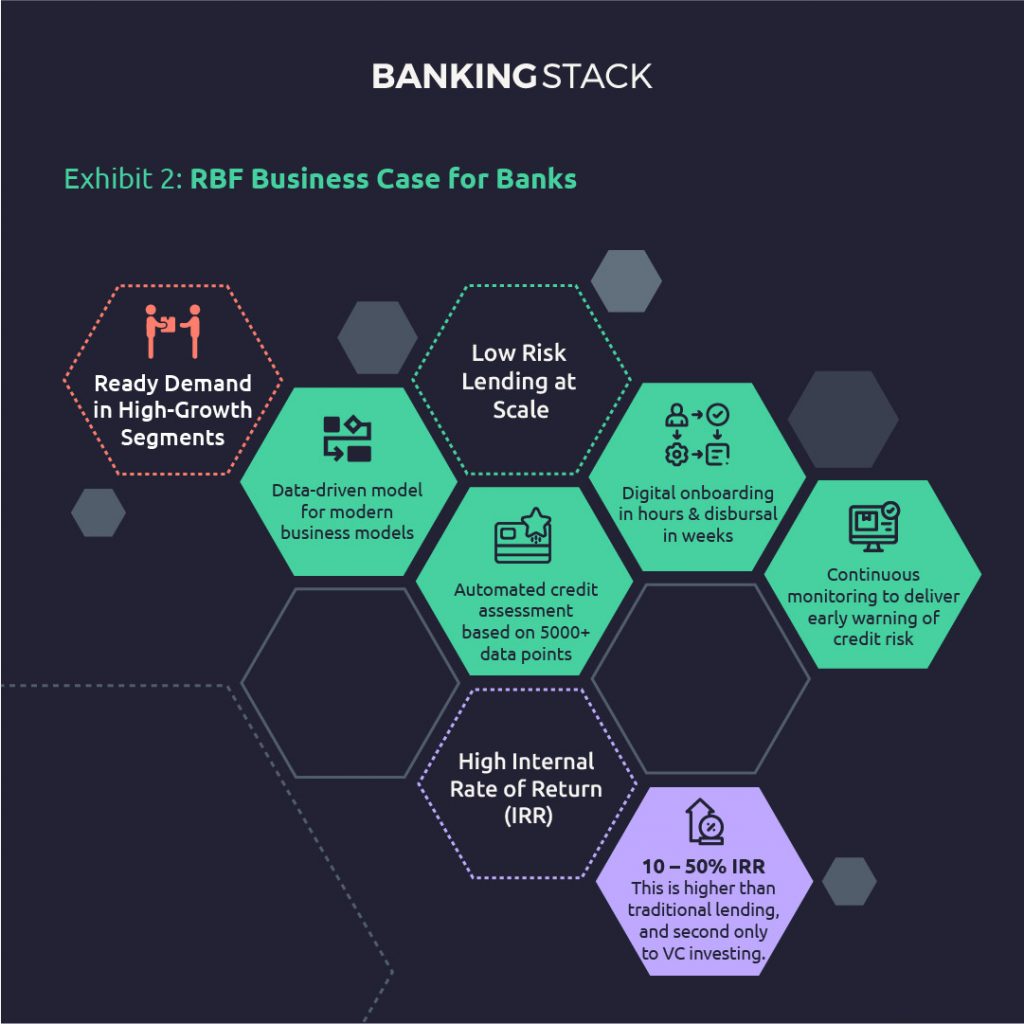

Revenue based financing (RBF) is an alternative lending model that uses a business’ revenue stream as its primary asset and collateral. Businesses can raise anywhere up to a third of their annual recurring revenue (ARR), or 4 to 6 times their monthly recurring revenue (MRR) as growth capital by pledging a share of their future revenues. The terms of financing are usually fixed at a specific multiple of the amount invested instead of an interest rate, ranging from 1.4X to 3X across lenders and borrower profiles. Repayment is to be made as a fixed percentage of the monthly revenue (between 1 and 10%), until the agreed upon multiple is repaid.

Importantly, revenue-based financing today is digitally-enabled; extensive APIs enable lenders to plug into a business’ financial data across sales, revenue, inventory, marketing expense, taxation and more, while automated underwriting models assess and deliver an offer in minutes.

Being collateral free (in the traditional sense) and a lot faster to underwrite and dispense, revenue based financing has immense relevance and potential in today’s business environment. Moreover, it allows businesses to raise growth capital without diluting their equity or taking on heavy debt servicing burdens. An Allied Market report estimates that the global revenue based financing market is projected to grow at 61.8% CAGR between 2019 and 2027 to exceed USD 42 billion (Exhibit 1). What’s interesting is that a bulk of this growth is expected to come from micro enterprises (CAGR of 65.4%), in terms of size of business, and Asia Pacific (CAGR of 65%) in terms of region1.

The RBF Imperative for Banks

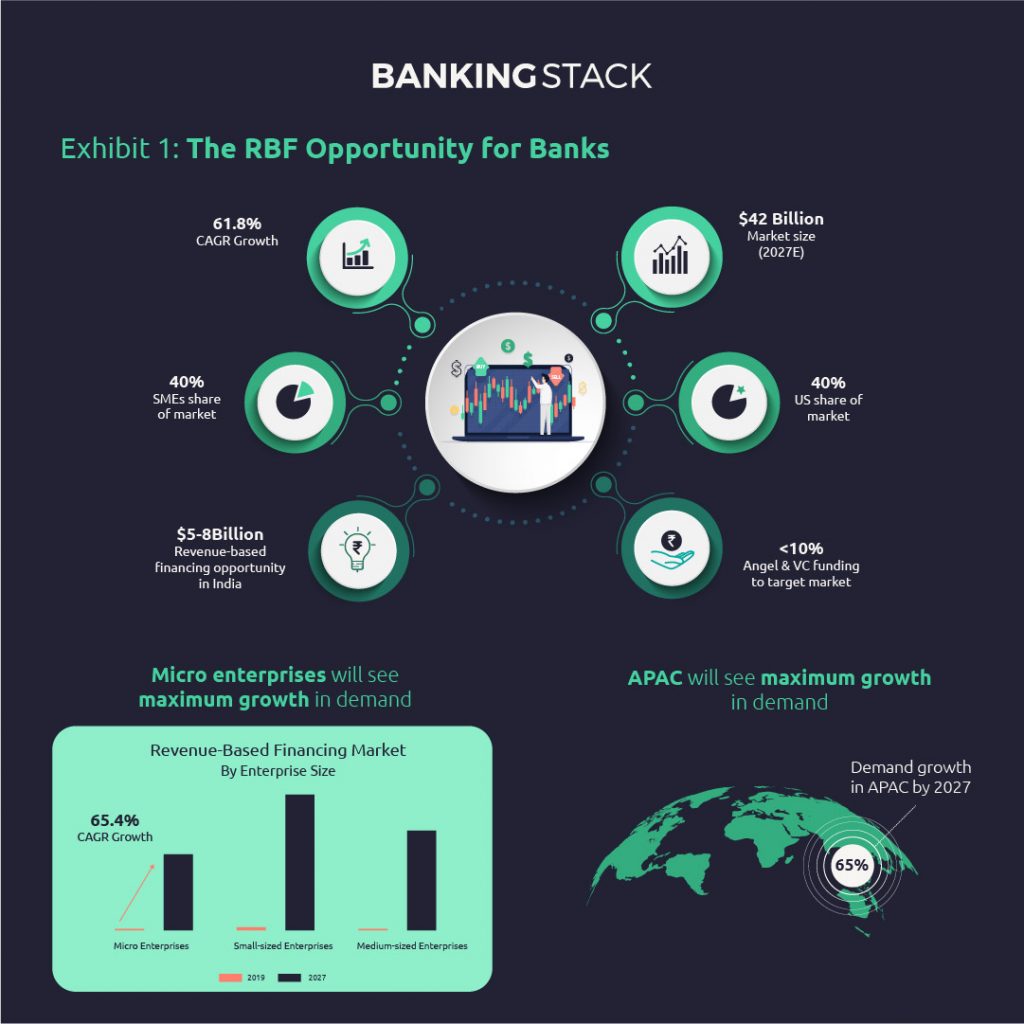

Despite their traditional strengths in lending, banks have stayed away from revenue based financing. Revenue patterns can vary significantly across businesses, especially in the SME segment, and legacy origination and underwriting models would never justify the effort and risk involved. However, with financial automation and growing digitalisation of SMEs, banks now have the opportunity to launch their own revenue based financing offerings, benefiting from (Exhibit 2):

- Ready market within desirable growth segments: SMEs, a traditionally underserved segment for banks, account for two-fifths of the revenue based financing market. As incumbent banks train their sights on winning and retaining SMEs against disruptive fintechs, a revenue based financing offering can deliver significant competitive advantage.

Because of the way it’s structured, revenue based financing is a particularly good fit for recurring revenue models like SaaS subscriptions, as well as asset-light business models like D2C businesses, gig economy businesses, marketplaces, etc. All of these are high growth segments, but heavily skewed towards fintech providers today. Revenue based financing can help banks unlock new segments with underwriting models that can understand these businesses. - Low risk lending, at scale: Traditional origination and underwriting processes at banks are lengthy, expensive and unable to assess modern business models. Importantly, they approach business performance retrospectively, and can only give a static assessment of the business’ credit-worthiness at a point in time.

Revenue based financing focuses on a business’ revenue stream as a key indicator of market fit and growth prospects, but the underwriting model uses anywhere between 20 to over 5000 business data points to give a detailed risk assessment of a specific business. The beauty is that with APIs and financial automation, the origination and risk assessment is completely digital. Businesses can be onboarded and served an offer in hours rather than weeks, and the actual disbursal can be made in days instead of months.

The underwriting engine also functions as an ‘early warning system’ for lenders. It continuously monitors the business’ performance and repayment data and can assess how and when their ability to repay may be impacted. - Higher IRR: Revenue based financing deals do not have a fixed repayment term since the amount repaid each month will depend on the revenue the business makes. This variability is the key risk for the lender. The faster the pre-decided multiple is repaid, the higher is the lender’s internal rate of return (IRR) – and vice versa. This risk is priced in to the multiple – ranging from 1.4X to 3X – that delivers attractive IRRs of up to 50%.

Let’s take an example: a revenue based financing deal of USD 1 million that carries a multiple of 2.5X will yield the lender USD 2.5 million in repayments. If the business manages to repay the amount in four years, the lender’s IRR would stand between 25-30%. If the business does well and repays the amount sooner, the IRR can touch 40%; whereas, if revenues sink and the repayment extends to 8 years, the IRR can dip to around 5.5%.

Another study of potential return scenarios in revenue based financing presents the IRR range as between 10% and 50% depending on revenue multiples up to 3X2. This places the earnings potential from revenue based financing higher than most traditional lending options, and second only to venture capital investments.

Inside the RBF Engine: Data-Driven Lending

One of the keys to the success of revenue based financing today is digital acquisition and onboarding. Not only does this drastically reduce the cost and time of originations, it removes the barriers to access for SMEs and startups, and can significantly increase new-to-bank (NTB) acquisitions through digital channels.

But it is the data analytics and artificial intelligence fed credit engine that is the heart of this product. Using APIs to plug into public and private databases, the engine establishes patterns in a business’ revenues, cash flows, sales transactions, credit records, as well as expenses pertaining to key business activities like logistics, sales tax, digital marketing, etc.

Based on the data patterns, the engine assesses the business for parameters like:

- Demand for product or service

- Competitive/pricing pressures

- Stability of revenue

- Potential for revenue growth

- Cashflow patterns

- Burn rate/expense margins

- Operational margins

- Credit behaviours

Where the objective of financing is to fund a specific business expense or function, the credit assessment will dig deeper into the efficiencies of that particular aspect. For example, if a business is looking for financing to grow digital customer acquisition and engagement, the model will plug into the business’ data on:

- Digital marketing and ad platforms like Meta, Instagram, Google Ads and Google Analytics to track spends and returns on spends; and

- Commerce or marketplace platforms that the business uses, like Shopify, Woo Commerce, Wix or Amazon, to track increase in visitors, conversion rates and sales

Mature credit models also account for variations across industries in factors like seasonality, business cycles, inventory turnover ratios, etc.

The final credit assessment is used by the underwriting engine to propose:

- Eligibility of business for financing

- Maximum amount of financing

- Share of revenue to be pledged by the business

- Expected tenure of repayment, which in turn, helps decide the financing fee, or multiple to be applied

Exhibit 3 illustrates the different components of a revenue based financing deal.

Helping Banks Go To Market Faster with RBF

Majority revenue based financing players today are fintech platforms, with the financial automation and open banking capabilities to develop their own underwriting engine. Among these, majority players including Clearco, Capchase, Wayflyer, Viceversa, Uncapped, Jeeves and Outfund, adopt a balance sheet lending approach3. This model is a natural fit for most traditional banks, and banks would have natural advantages over most fintechs in this model. The cost of capital alone makes it challenging for non-bank fintechs to make profit using revenue based financing.

Other players in the market adopt a marketplace model. Fintechs like Pipe, Re:cap and Velocity operate a revenue based finance marketplace that pairs borrowers with lenders.

Banks are acknowledging the revenue based financing opportunity too, and a few early adopter banks have partnered with fintechs to test the waters. Barclaycard has entered into a partnership with embedded finance platform Liberis to offer personalised revenue based finance to the platform’s SME customers. This partnership sees the integration of the Barclaycard Business Cash Advance service with Liberis’ Cash Advance service4.

iwoca, one of Europe’s largest small business lenders, has partnered with Funding Xchange UK, an SME funding marketplace with digital eligibility and assessment tools. iwoca launched an industry first, fully automated revenue based repayment loans facility for Funding Xchange’s customers, looking for loans between GBP 1000 and 50,000 on the online marketplace5.

While existing examples are more on the lines of merchant relationships between banks and fintechs, we believe that banks can see transformational lending revenues from adopting the credit underwriting piece in-house. With traditional strengths in balance sheet lending, and potentially wider access to business data through fintech-powered business banking accounts, banks can create market-defining revenue based financing products with their own credit engines.

In this context, banks can consider partnering with a fintech to invest in or white-label an entire revenue based finance solution, as enabled by BANKINGSTACK. With a market-ready module that delivers the credit engine, the API stack, as well as the onboarding and servicing workflows, banks can:

- Go to market faster: Banks can launch their revenue based financing product in weeks, significantly enhancing their acquisition and engagement in the SME segment.

- Benefit from continuous innovation: BANKINGSTACK is a cloud-native OS, which means enhancements made to the credit engine, API stack or workflows, will be auto-updated at the banks’ end.

- Low/zero capex: With SaaS-based approach to the partnership, banks can adopt and deploy revenue based financing with minimal or no capex involved. The BANKINGSTACK modules sit on top of existing legacy infrastructure, requiring minimal integration effort.

References:

- https://www.globenewswire.com/news-release/2021/02/08/2171492/0/en/Global-Revenue-Based-Financing-Market-to-Garner-42-34-Billion-by-2027-AMR.html

- https://npl971975.wordpress.com/2019/02/06/suu-tam-revenue-based-financing-in-vc-a-study-on-playing-averages-over-home-runs/

- https://dealroom.co/blog/reinventing-business-capital-revenue-based-financing

- https://techfundingnews.com/liberis-gets-34-5m-funding-from-barclays-partners-to-finance-smes-struggling-with-access-to-capital/

- https://financialit.net/news/open-banking/iwoca-and-fundingxchange-partner-offer-fully-automated-merchant-cash-advance