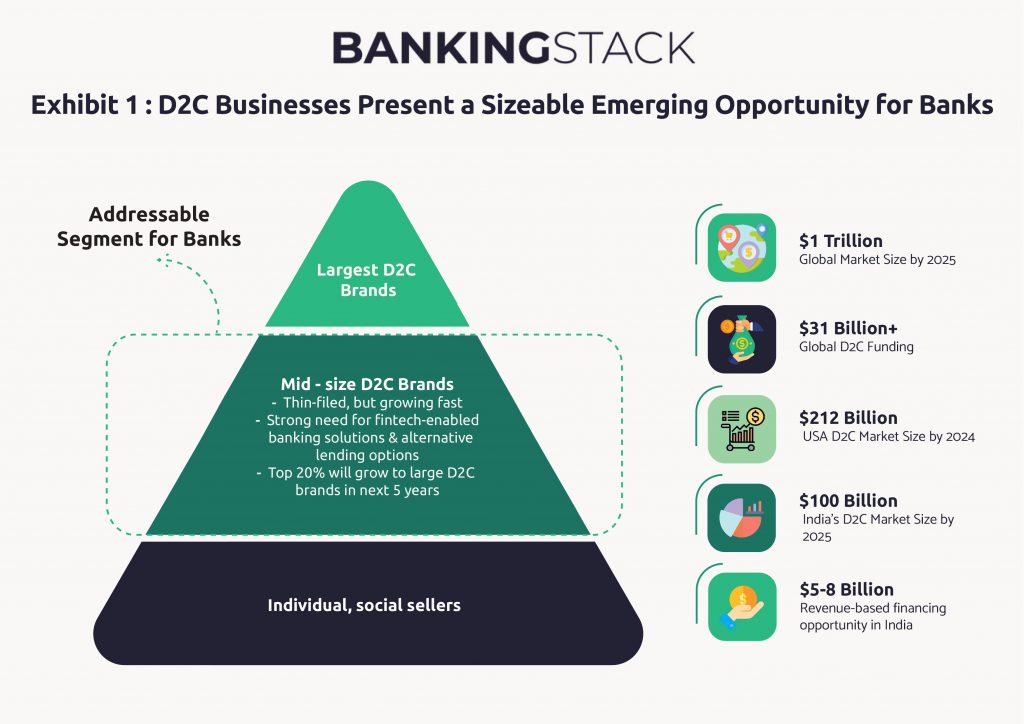

The global D2C market is expected to reach a valuation of USD 1 trillion by 2025, while India’s D2C market size is estimated to reach USD 100 billion1.

With massive potential for banking support and capital infusion, the ongoing explosion in the global direct to consumer, or D2C business ecosystem, presents tremendous untapped opportunities for banks. In India, the D2C segment now has over 600 brands with their combined revenue estimated at over INR 14,000 crores2. Further, while major beauty brands needed 20 years to realise a revenue mark of INR 100 crores (USD 12.6 million), D2C brands like Mamaearth and Sugar achieved this in just four years3. Larger retail brands are taking note of the growth in this segment, which has led to several acquisitions of fast-growing mid-size D2C brands. Reliance Retail Ventures Limited (Reliance Retail) recently acquired majority stake in D2C innerwear brand Clovia4, whereas Tata Consumer Products Limited (TCPL) acquired food beverage D2C brands NoursihCo Beverages and Soulfull5.

Popular global examples of D2C brands include Warby Parker, which took on behemoth Luxottica, the parent company owning Ray-Ban, Oliver Peoples, Oakley and others brands. D2C brand Dollar Shave Club managed to grab a large chunk of business from popular shaving brands like Gillette, and reported USD 200 million in revenue during the first five years of operations6.

The emerging opportunity for banks lies in the mid-size D2C businesses, that may be thin-filed now, but have established market traction and are growing fast.

Exhibit 1 presents a broad segmentation of the the D2C market. The mid-size D2C segment can benefit the most from fintech-enabled digital banking and lending solutions that integrate business and financial workflows with banking. With significant potential to grow into the next tier of larger, established D2C brands in the next five years, banks should engage with mid-size businesses now to entrench themselves as preferred service providers.

The D2C Business Banking Gap

The D2C ecosystem gained ground during the pandemic era; D2C brands became a lifeline with people restricted to their homes, offering them access to different kinds of products and services, always digitally, and often with a hyperlocal delivery context. Post-pandemic, buyers have retained their affinity for shopping online and experimenting with niche brands. According to the Direct-to-Consumer Intent Index7, about 80% of consumers are likely to purchase products from D2C brands in the next five years, indicating the enormous potential for expansion in this segment.

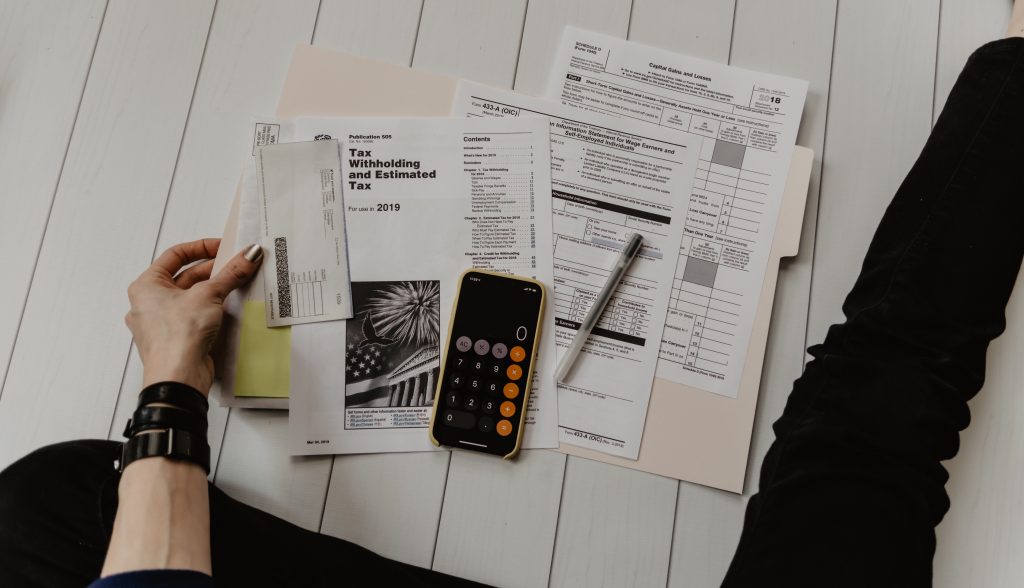

Despite this potential, driving actual revenue growth proves challenging due to operational and market-led challenges. Inability to access growth capital, lack of visibility into sales and performance, and complexities in accounting and taxation remain some of the stronger headwinds for D2C businesses.

Managing working capital is a perennial challenge for D2C brands as payments made through cash on delivery (COD) and payment gateways take between 2 to 7 days to settle, and more than 65% of consumers choose COD as the preferred mode.

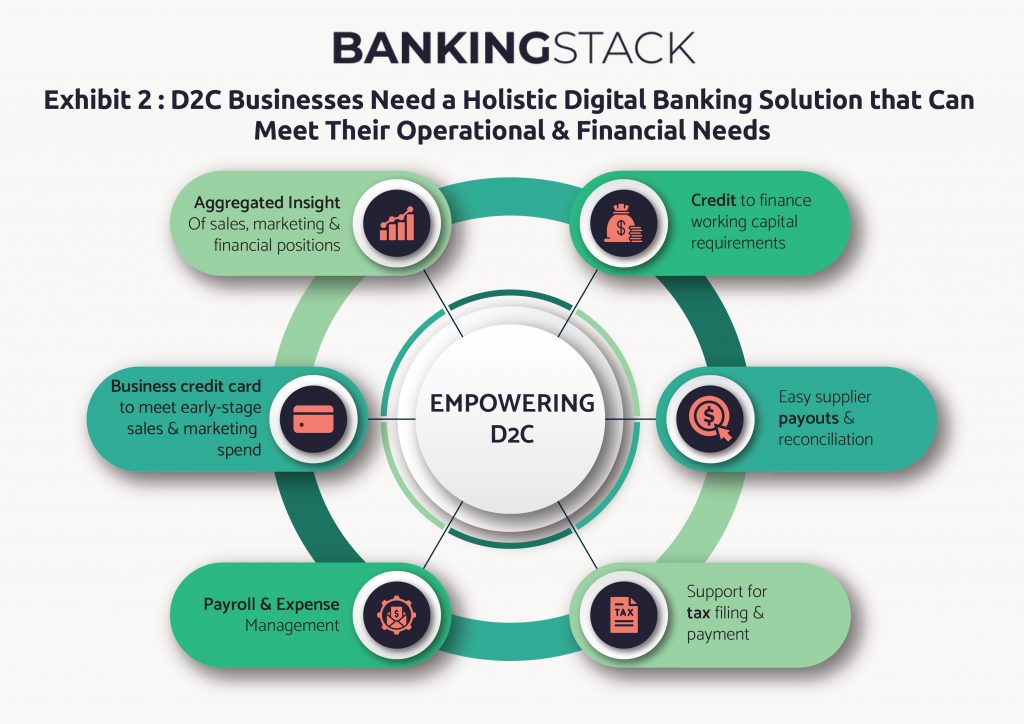

Standardised banking products and services are unable to service the nuanced needs of the mid-sized D2C businesses. And D2C entrepreneurs do not have the necessary resources or know-how to streamline their business data across finance, operations and banking. Exhibit 2 lists the kind of holistic ‘run-the-business’ and ‘grow-the-business’ solutions that D2C businesses need.

For example, payments, collections, and refunds are a significant activity for D2C businesses. Features like multi-modal payment gateways for maximising collections, payout links for easy refunds, and payout APIs that enable bulk and scheduled payments are some key requirements for efficient functioning. Capabilities like auto reconciliation; tax-compliant digital invoices; auto-calculation of dues per delivery; and instant settlements to vendors, delivery agents and employees, further reduce complexity and help business owners have a clearer picture of their cash flow on an ongoing basis.

A similar drill down into each solution area reveals critical fintech-enabled elements that are missing from banking solutions today, and are a must-have for D2C business owners.

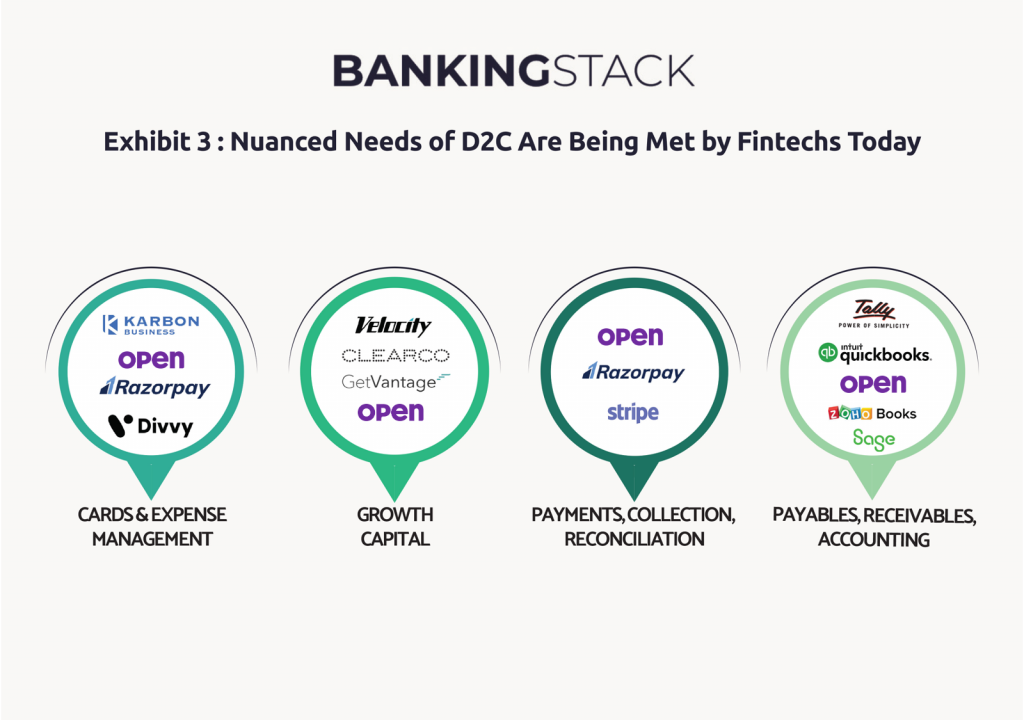

D2C business banking needs are currently being met by fintechs that have taken a ground-up approach to building solutions around these white spaces.

Exhibit 3 shows an illustrative list of fintech companies that are being preferred by D2C businesses across accounts, bookkeeping, payments, lending and cards.

Rise of Revenue-Based Financing to Fill D2C Financing Gap

In just the first quarter of 2021, D2C brands in the US raised USD 1.3 billion via venture capital funding, while Indian brands raised USD 500 million. However, there has been a gradual cooling of interest since then as the market and economic environments have become more challenging globally.

D2C businesses too, seem to be moving away from trading equity and control for funds, preferring instead to depend on credit. This, however, proves to be a vicious circle as most mid-size D2C businesses are unable to qualify for traditional banking credit.

Fintechs, with access to D2C business’ sales and cash flow data, have innovated around lending models that can leverage these alternative data sets. Revenue-based financing, or flow-based financing, is one such use case that is seeing a strong product fit in D2C businesses that have regular revenue, but may not be profitable yet, nor have the collateral or credit history required for traditional lending.

Clearco, formerly Clearbanc, offers founder-friendly capital solutions for e-commerce businesses. Ranging from revenue based financing, to inventory financing and marketing capital, Clearco plugs into business’ tools that track key metrics like sales and ad performance and offers finance in return for a share of future sales as mode of repayment. According to Michele Romanow, President and Co-Founder of Clearco, “Revenue based financing is often a far more compelling proposition for Founders than venture capital or business loans…Founders get to keep full ownership of their business rather than giving up equity—as is the case with venture capital—and there is no risk of default as there is with a loan.”

In India, platforms like Velocity and Open create a holistic overview of D2C brands’ creditworthiness by analysing metrics such as online sales volumes, marketing, and credit and taxation data. The model prioritises D2C businesses with predictable margins and high growth trajectories to issue financing, which can then be repaid as a share of future revenues.

Shaping Banks’ Response to the D2C Opportunity

Broadly speaking, everything that banks would do to enhance their digital banking model for the small and medium business segment would apply to D2C as well. However, there are certain specific solutions that have critical applicability for these businesses. Banks can find instant traction in this fast-growing segment with capabilities like:

- A neobanking engine that delivers an integrated dashboard with insights across orders and sales, marketing and ad spend, business expenses and aggregated financial position

- A curated list of API plug-ins catering to digital marketing and advertising, logistics, influencer networks, and more

- Low-code, no-code banking-as-a-service elements allowing businesses to easily embed services (for example, BNPL) for their customers

- Corporate credit and prepaid cards solutions bundling in cards issuance and controls, virtual cards, expense management, and a higher limit enabled by alternative underwriting models

- Relevant and straightforward reward and deal mechanisms on cards

- Scaled low-risk lending options like early settlement loans, revenue-based financing and SME BNPL

A search for the best business bank accounts for D2C or e-commerce businesses returns a list of digital-first challenger bank accounts.

However, we are seeing global instances of successful bank-fintech collaborations that can help the banks target the high-growth D2C segment.

- Lending/Working Capital Financing

- DBS Bank has partnered with CredAble to enable trade financing and cater to the day-to-day capital requirements of SMEs, MSMEs and enterprises facilitating corporate supply chains8

- Tradeshift and HSBC have partnered to enable businesses to better manage their working capital needs, while assisting companies keen on digitalising and automating their operations

- Wells Fargo is leveraging nCino’s small business banking solution to streamline its lending process for origination, underwriting and portfolio management9

- Cards & Expense Management

- Silicon Valley Bank (SVB) has partnered with Teampay to offer seamless spend management controls to business card holders10

- AmEx has partnered with Extend to allow millions of its SMB customers access to virtual cards through their existing physical cards11

- Payments

- Lithuanian challenger bank SME Bank has partnered with payments technology firm kevin. to enable account-to-account (A2A) payments across the Baltics, payments into a single business account as well as AI-powered collateral-free revenue-based financing12

- ABN AMRO, the third-largest bank in the Netherlands, has partnered with Dutch fintech Subaio to enable their customers to manage recurring payments online13

Despite these initial moves, there are significant white spaces in the digital banking offerings for D2C businesses. Banks need a faster, non-capex intensive approach to improve their product fit and customer engagement capabilities to compete in this market. With this approach, banks are not only positioning themselves for the D2C segment, but for the overall modern digital banking opportunity worth billions of dollars, which will primarily be driven by segment-specific product fit and alternative lending models.

References:

- https://brandequity.economictimes.indiatimes.com/blog/house-of-brands-or-house-of-cards/91756091

- https://www.fortuneindia.com/long-reads/indias-d2c-brand-sweep/108083#:~:text=India%20is%20now%20home%20to,senior%20partner%20at%20Technopak%20Advisors

- https://www.nextbigbrand.in/growth-of-d2c-brands-in-india/#:~:text=Inc42%20Plus%20recently%20released%20a,to%20%2433.1%20billion%20in%202020

- https://inc42.com/buzz/reliance-retail-acquires-majority-stake-in-d2c-lingerie-brand-clovia-for-inr-950-cr/

- https://www.exchange4media.com/marketing-news/fmcg-start-up-acquisitions-what-does-it-mean-for-d2c-ecosystem-120936.html

- https://www.qualitydigest.com/inside/innovation-column/1b-lessons-innovation-dollar-shave-club-113021.html

- https://www.krishtechnolabs.com/blog/d2c-in-ecommerce-the-new-business-imperative-on-the-rise/

- https://bfsi.economictimes.indiatimes.com/news/industry/top-banks-and-fintechs-partnerships-in-2021/88604384

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/fintech-focus-wells-fargo-taps-ncino-for-division-s-digital-transformation-69573117

- https://www.globenewswire.com/news-release/2021/04/30/2220633/0/en/Teampay-Partners-with-Silicon-Valley-Bank-to-Offer-Seamless-Spend-Management-Controls-to-SVB-Business-Card-Holders.html

- https://www.paywithextend.com/pages/american-express

- https://www.paywithextend.com/pages/american-express

- https://www.fintechfutures.com/2022/06/lithuanias-sme-bank-partners-kevin-for-a2a-e-commerce-platform/

- https://bfsi.economictimes.indiatimes.com/news/industry/ten-successful-bank-fintech-partnerships-that-are-generating-revenue/91791815