The past decade has revolutionised the way businesses use credit cards. From a tool to manage working capital credit, it has today become the primary channel for expense management across functions and geographies. The credit card equation is now focused on greater control and transparency in spend management rather than just credit. Unfortunately, banks and other traditional credit card issuers are still catching up to this shift, leading to significant friction in the way businesses want to use their corporate cards and the available offerings.

In a telling instance, Olivier Kidd, CEO & Founder of Australian corporate card and spend management platform, was refused an AUD 5000 limit corporate card program despite having millions in the bank. The experience made him realise that banks misunderstand why companies apply for corporate credit card programs. Only a small percentage of these companies need credit; their main purpose is to help their teams spend in a secure and scalable way1.

The other aspect of friction in the market, of course, remains the underserved small and medium businesses (SMB) market, and specifically the growing micro and gig economy businesses with non-traditional business models. According to a report published by Mercator, SMB credit card transactions are expected to exceed USD 700 billion by 2023 up from USD 500 billion in 20172. Much of this value is being driven by challenger banks and fintechs who have innovated segment-sensitive cards, designed to help these businesses establish a credit record and manage their business expenses in a seamless manner.

The overall market size of the commercial cards business, when seen through the lens of this expanded scope, is significantly more than the traditional market as sized by banks. We look at this expanding market scope, the white spaces where fintechs are rapidly entrenching themselves, and what banks can offer to stand their ground in the commercial cards space.

Mismatch in commercial cards offerings

The World Retail Banking Report (WRBR) 20223, published by Capgemini and Efma, indicated that 49% of the global respondents were disappointed with their current banking relationships, with complaints including a lack of emotional connection or rewarding experiences. 52% of the surveyed individuals mentioned that banking was not ‘fun’, and this aspect is making them susceptible to poaching by fintechs offering efficient and technology-driven card issuance, management, and integrated expense management experiences. The WRBR further elucidated that 75% of the respondents were keen on trying the cost-effective and seamless services offered by fintech firms as they felt these would be more rewarding, engaging, easy, and approachable.

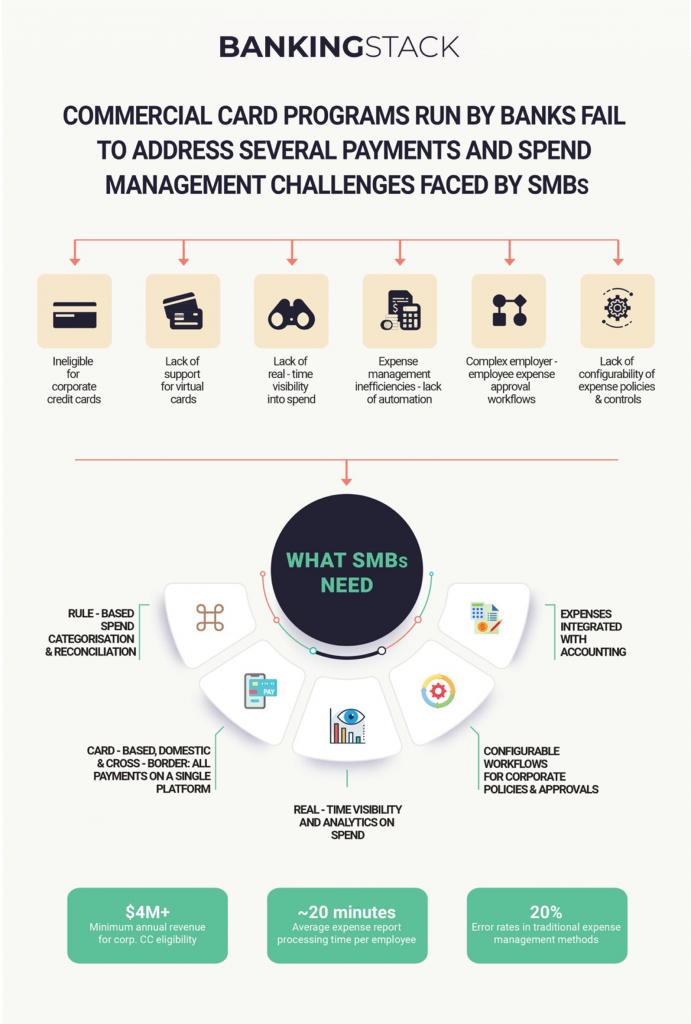

For SMBs, traditional commercial card solutions are difficult because their creditworthiness cannot be truly assessed using traditional metrics like income and profitability. This pushes them into a vicious cycle of lack of capital due to the absence of credit history and becomes detrimental for their survival.

Additionally, while SMB credit cards have traditionally served to a) establish a credit history and credit score, b) manage cash flow, and c) enable easier access to credit, challenges like lack of visibility or control on spends and frauds are additional hurdles. Further, effort spent on payment reconciliation, high cost of transactions, and lack of tailor-made and integrated solutions by service providers are some of the other hurdles SMBs face when it comes to payments and spend management.

Growing revenue opportunities

For banks, there is enormous potential in upgrading their commercial cards solutions, with reports estimating that that global commercial cards revenue can grow to USD 49.3 billion by 2026, at a compounded annual growth rate of 7.3%4.

Currently, fintech-led use cases, like virtual cards integrated with expense management capabilities, are causing significant churn in commercial cards and opening newer growth avenues. According to Scott Orn, COO of Kruze Consulting, “Deciding what credit card to choose is something we are asked about all the time at Kruze. Right now, it’s all about expense management tools and we are seeing every major card compete over the best digital offering they can bring to market.”5

Further, Kruze data suggests that, between 2018 and 2021, the market share of traditional card issuers like Chase, American Express and Capital One have plunged from 75% to 35%, indicating the need for a serious and proactive makeover.

The downfall of traditional cards is occurring in tandem with the growth in virtual cards as these new entrants boost value for SMBs by making payments easier and simplifying the process with data analytics and money management. According to a Juniper Research report on virtual cards6, the total global virtual card transaction value is expected to reach USD 6.8 trillion by 2026, witnessing a CAGR of 370% between 2021 and 2026.

Fintechs powering novel use cases

Fintechs are identifying niche segments and customer pain points to come up with value-added services aimed at empowering card users. For example, select fintechs are entering the card management systems space and offering integrated expense management which allows SMBs to use features like virtual cards, real-time spend approvals/notifications, and integration accounting software, thereby expanding the scope of how SMBs look at their credit card utility.

According to Kausik Rajgopal, Senior Partner at McKinsey & Company, “Most smaller fintechs who focus on a card are trying to solve an issue for a particular segment of customers, for example, helping new-to-banking customers build credit or providing less expensive financing for purchases.”7 And this is what is setting them apart from traditional lenders – a keen eye on the gaps in card services and an eagerness to step in and offer a seamless remedy.

Globally, top corporate expense management systems like Brex, Zeta, Divvy and Volopay, among others, have captured substantial market volume, with the corporate expense management funding at USD 2.8 billion as of 2021.

Incumbent banks need a volte face

With fintechs shaping the commercial credit card market around comprehensive and value-adding services, banks need to add these capabilities to regain their foothold in the ecosystem. According to the Deloitte Consumer Payment Survey, “To revive their relevance, credit card issuers should revisit their value proposition and find ways to offer more personalisation and a frictionless payment experience.”8

Banks can ease the transition by choosing one of the following strategies:

- Buy or rent white-labeled platforms to enjoy the quickest go-to-market process, realise higher ROI and ensure best-of-breed functionality. However, this strategy may have disadvantages such as a limited choice of enterprise platforms and possibly higher total cost of ownership.

- Build on the incumbent card management systems to ensure low disruption in the pre-existing setup and enable greater control and seamless governance. Since the bank would need to build the entire system, this strategy would prove expensive and take more time than the other two strategies.

- Partner with top fintech platforms and facilitate a faster than in-house build with least IT disruption. This strategy can help banks go to market faster, with ready integration with their existing channels. A cloud-native solution would ensure low total cost of ownership, as well as ease of continuous upgrades and enhancements.

There have been multiple global use cases wherein banks have successfully worked with fintechs to offer value to customers. For instance, Citi Commercial Cards has collaborated with fintech Edenred to enhance its corporate spending innovations and AmEx has associated with Extend to offer virtual card access to SMB customers who already possess physical AmEx credit cards.

Open’s neobanking platform, Open Money, has been leading the change in commercial cards solutions for small and medium businesses in Asia. And with the BANKINGSTACK OS, banks can adopt and launch a market-ready solution featuring comprehensive cards issuance, spend policy setting, spend analysis and control, and real-time approval capabilities in a matter of weeks.

References:

- Companies Race to Empower Teams to Spend Securely | Pymnts

- Small Business Credit Cards: Growth Opportunities in a Post-COVID World | Mercator Advisory Group

- Banks Globally Need to Keep Pace to Compete with Fintech Players | Business Standard

- Commercial Or Corporate Card Market Size And Forecast To 2026 | Coherent Market Insights

- Kruze Consulting Reveals the Best Credit Cards for Startups | PR Newswire

- Virtual Cards Statistics | Juniper Research

- How Fintech Companies are Changing Credit and Debit Cards | The Balance

- Getting Ahead of the Curve: Reviving the Relevance of the Credit Card | Deloitte