Even as demand for loans increases across sectors, there are multiple fronts on which banks can do more to turbocharge profitability. At the time of writing this article on connected banking, the banking world is responding to rising interest rates worldwide as policymakers combat a hike in global inflation precipitated by a host of macroeconomic factors. For banks, this means an added pressure on their net interest margin (NIM) as they increase deposit rates to attract funds to support sustained high loan growth.

The value pool serviced by banks hasn’t remained static either. Financial products and services such as embedded finance gradually percolate from individuals to businesses and SMEs. Rapid digitisation of SMEs has paved the way for the creation of digital ecosystems where Fintechs collectively integrate new product propositions and services. Core bank functions and revenue streams are unbundled as specialised embedded finance services and delivered through platforms.

Incumbent banks’ resources need to be better channelled to adopt new capabilities in this fast-evolving digital ecosystem: a fact that is indicated by the shift of revenue from banks to fintechs and big techs. Take Amazon, for example, which has practically transformed into an unbundled bank by offering SMEs everything from payments and lending to insurance and cash deposits. Payments reports show that big tech companies like Amazon and Apple could grab up to 40% of the $1.35 trillion in US financial services revenue from incumbent banks[1].

But as at any inflection point, winners will demonstrate foresight, persistence, and innovation to emerge stronger. Even within the pervasive climate of a banking crisis, trust is fast restored in banks with systemic support in the event of failure. While banks are well placed to reassure their users of stability, they need a step change in their capability to participate in the digital ecosystem to grow their deposits, given the competitive financial system and technology disruption.

Building a connected service model provides an elegant solution: a bridge where the customer journey between different stakeholders and different offerings is coherent and seamless. This would retain business engagement for banks and drive purchase of innovative products and services without the need to organically build them in-house. More importantly, given the enormity of the banking industry, consolidation would help to manage systemic risks in the medium term.

There is a terminology commonly attributed to this bridging effort: Connected Banking.

What is connected banking?

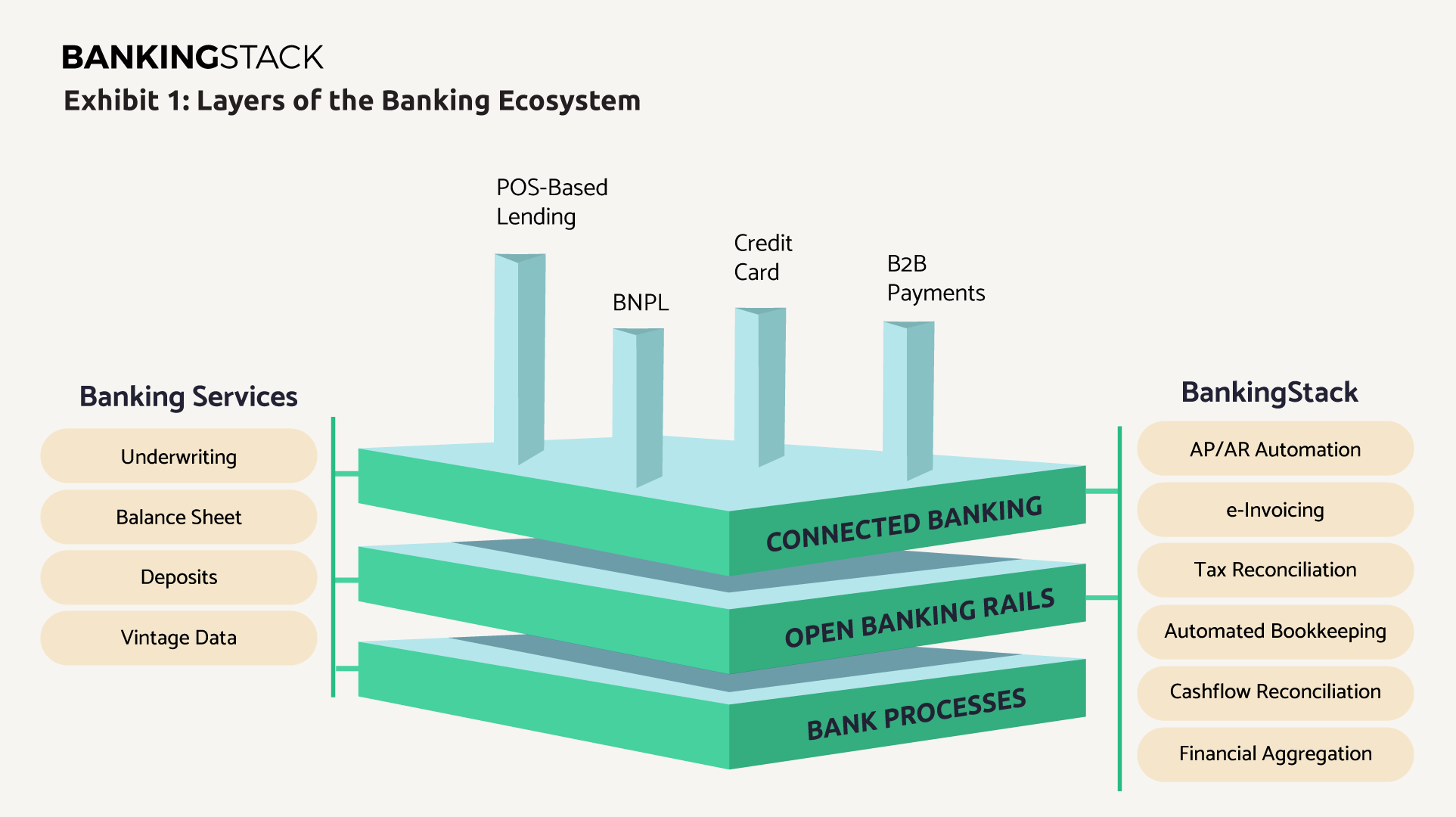

Connected banking, or ecosystem banking, is a relationship model for banks. The digital front end delivers a seamless customer experience and additional products, brought in at the back end through pre-integrated, standardised APIs and segment-specific fintech or third-party platforms.

Connected banking is akin to an extended ecosystem of a bank that integrates with the larger digital ecosystem of specialised banking and non-banking products and services like insurance, digital wallet spending, retirement accounts, tax filing, invoices, investments, personal or business finance management and reconciliation. At the front end, the customer engaged with the bank experiences a smooth, continuous digital journey, while the bank nurtures an omnichannel engagement with multiple products offered by different fintech platforms.

Customer experience is the key driving force behind connecting banking. Product innovation enriches the customer journey using new and disruptive technologies like AI and robotics. Another essential attribute of this experience is data ownership. The right-sized consumer data access to third parties in the back end is based on flexible consumer consent. The ownership stays with the banking institution, regulated by data compliance and cybersecurity guidelines. Since this model is spearheaded by banks, it retains their primacy with businesses

The underlying enabler to connecting banking is the open API and microservices architecture; it is standardised and thus effectively manages data control. Various stakeholders or service providers are hyper-connected with an open but centralised network of connections, resulting in accelerated operational efficiency.

It is a 2-way model between banks and third-party platforms. One is where banks allow partners to incorporate products, data, and processes into their banking system. Another where banks join third-party platforms to offer their banking products to third-party customers.

The terms open banking and connected banking are often confused, so it is worth highlighting the fundamental differences between the two here.

Difference Between Connected Banking and Open Banking

|

Connected Banking |

Open Banking |

| Connected banking is a relationship model where banks offer their APIs to partners like fintech players, who can implement these and create solutions for their target segment. The digital front end delivers a seamless customer experience and additional products, brought in at the back end through pre-integrated, standardised APIs and segment-specific fintech or third-party platforms. | With its roots in the PSD2 (payment services directive) at the European Union, open banking facilitates the sharing of crucial information between the bank and third-party entities for the customer’s benefit. This is only allowed once the customer provides consent to the entity to access data from the bank. In India, this is commonly translated as the account aggregator framework. |

Connected banking creates a win-win model for banks and fintechs as it brings value to both.

Businesses and SMEs benefit at three levels

- Access : They get access to a broader range of services/products from a single point. They have to only one interface for all banking and account services. Technology-based banking value-added services available from a single window helps to increase their operational efficiency

- Experience : Their customer experience is streamlined when they engage with the bank as services are intuitive, fast and seamless. It shortens time for data retrieval required for various functions.

- Operational simplicity : Ecosystem banking offers the end user the comfort of interoperability and multiple utilities from one access point, without having to move across systems. For example, connected banking can link facets of finances like invoicing, tax filing, accounting, bulk payments and expense management, all in one ecosystem for the end user.

Banks also have multi-faceted benefits

- Expanded customer base and new revenue streams : Banks can offer new, innovative products (from the ecosystem) to primary customers and stay ahead of incumbent competition; on the other hand, they can generate new revenue streams by entering new segments and accessing a new customer base.

- Better customer relationships and customer intimacy : They can expand primary customer relationships and follow customers when they use the extended connected services or tools from other stakeholders. Technology also helps create better transparency and ownership in financial transactions.

- Tailor-made solutions for increased customer loyalty : Banks can understand the needs of businesses for credit, working capital and operation efficiency and offer customised solutions. They can reduce customer churn by joining third party ecosystems to deliver more meaningful customer experiences.

- Increased deposits : Put simply, connected banking makes inflow and outflow of money easy. And since propensity to fund an account is dictated by its use, which depends on being able to make and receive payments easily, engaging the user in the ecosystem longer increases deposits for the bank.

Connected Banking: Bringing fintech ecosystems to bank customers

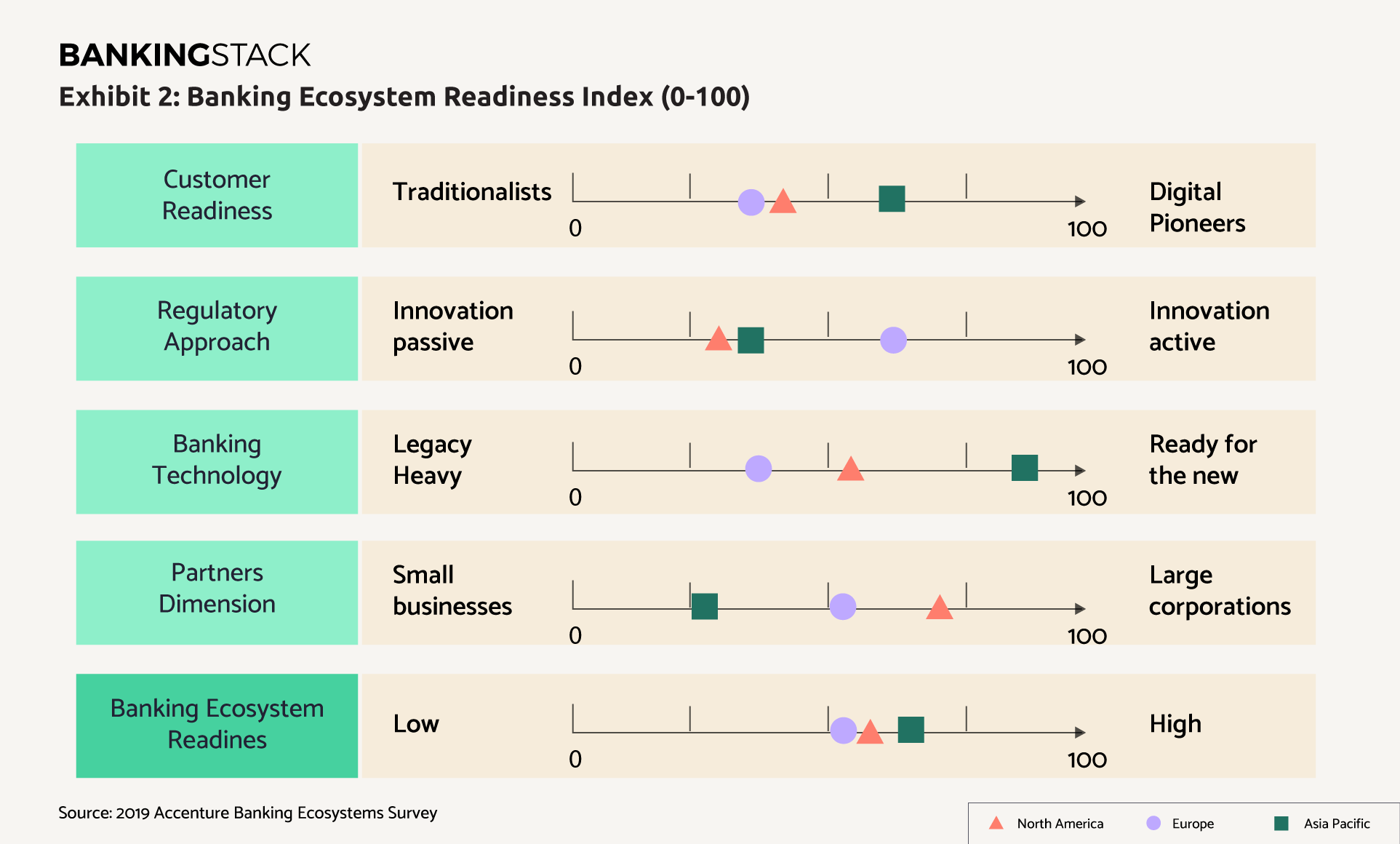

A Banking Ecosystem Readiness Index ranking, created by Accenture after a banking ecosystem survey, illustrates that banks are working towards expanding banking ecosystem readiness and that it is relatively similar across regions, with APAC in the lead (Exhibit 2)[2].

Let’s explore how banks and Fintechs are increasingly partnering to put the best foot forward.

Case in point 1 – HSBC’s connected banking offering [3][4]

HSBC offers an integrated platform called HSBC Scholar in mainland China, beyond an online cross-border money transfer for school fee. It provides practical guidance on overseas education to customers and is accessed via a WeChat Mini Program. Connected with the WeChat ecosystem, it also offers a digital membership program to gain financial knowledge, where progress can be shared via the WeChat account.

HSBC HongKong offers an SME platform VisionGO for P2P knowledge sharing.

HSBC Singapore has a long standing program of an Innovation lab to work collaboratively with tech providers in developing next-gen of digital and mobile services for corporate banking needs in payments, trade, supply chain and subsequently in retail banking.

Case in point 2 – Leading Indian lender benefits from connected banking offering

One of India’s top five private lenders leveraged BANKINGSTACK, our modern, cloud-native fintech operating system for banks and financial institutions, to offer SMEs a holistic business platform seamlessly integrated alongside their business banking offerings. The bank recently launched a credit card for startup founders to tackle challenges around expense management and credit score building, with a provision for instant settlements to e-commerce merchants and instant overdrafts across SME business types.

The offerings resonated in the market, delivering 10% growth in customer acquisition per month, 3X growth in current account deposits and an overall increase in the number of SMEs who consider the bank their primary provider.

Conclusion

Present day banking customers, particularly SMEs, have a host of unaddressed needs. Banks can tap into this gap and offer new propositions through connected banking by partnering with BANKINGSTACK. With our readymade integrations and open API solutions, you can drive similar results for your organisation.

To know how we can help, book a demo, or write to us at: letstalk@bankingstack.com.

[1] https://www.insiderintelligence.com/insights/financial-services-industry/

[2] https://www.accenture.com/_acnmedia/pdf-102/accenture-banking-ecosystem.pdf

[3] https://www.hsbc.com/insight/topics/digital-banking-transcending-transactions

[4] https://www.accenture.com/_acnmedia/pdf-102/accenture-banking-ecosystem.pdf