Small and medium enterprises (SMEs) in the United Kingdom are undergoing a period of resurgence after the impact of Brexit and the COVID-19 pandemic. According to the Barclays SME Barometer, in Q2 2022, UK SMEs reported an 11.4% increase in revenues compared to the same period in 2021. At the same time, the segment has been undergoing a systemic transformation spurred by macroeconomic catalysts and a digital overhaul of industries on a global scale. The emergence of digital-first business models (like D2C, vertical SaaS, and niche marketplaces) and SME categories (like influencers, gig workers, freelancers, and remote businesses) has extended the long tail of small businesses striving for growth.

Traditional SME lending is lagging this transformation by years. Prevalent underwriting methodologies have struggled to assimilate the new business and revenue models. Importantly, they are not leveraging the potential for adaptive and ongoing risk assessment made possible by digital data flows. This is an important step towards lowering the barrier for thin-filed SMEs, or those with seasonal or cyclical variations in revenues.

This article looks into the imperatives for incumbent banks and financial institutions in the UK to lead the innovation in SME lending through underwriting with alternative data.

Evolving SME Lending Landscape in the UK

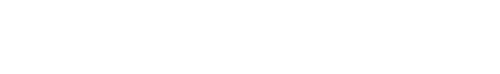

Traditionally SME financing in the UK has been led by high street banks. Following the distress of the 2008 crisis, lending to SMEs, typically seen as a high-risk, high-cost effort, declined drastically.

Around the same time, a slow but steady undercurrent of fintech disruption started making its presence felt. Policy makers took note of SMEs’ declining access to traditional sources of funding, as well as the potential of fintech in addressing these challenges, and issued an important series of measures. The measures sanctified challenger banks and alternative lending platforms, and enabled an alternative banking and financing market to be set up for SMEs in the UK.

- The Financial Services Act 2012 led to the emergence of challenger banks in a bid to improve competition in the financial services sector.

- Similarly, the Government has driven the support for data democratisation through initiatives like Open Banking and Smart Data. The recently published Spring 2021 report of the Smart Data Working Group highlights benefits for SMEs around use cases like spend management and business financing.

- The 2015 Small and Medium Sized Business (Finance Platforms) Regulations acted as a catalyst in favour of the new-age alternative lenders, mandating big banks to refer underserved SMEs to alternative financiers if the bank rejects their loan application.

As a result of these tailwinds, the contribution to SME financing of alternative lenders, challenger banks, and asset finance companies grew by 56% between 2014 and 2019. In comparison, the contribution of big banks fell by 14% during the same period. As per Innovate Finance, the market share of alternative lenders stood at about 9% pre-COVID, which grew to almost 20% during the pandemic spurred by government-backed financing schemes like CBILS (Exhibit 1). Following the initial high-demand quarters of the pandemic, gross lending to SMEs per quarter has stabilised around the GBP 4.9 billion mark from the second half of 2021.

Innovation Opportunities in SME Lending

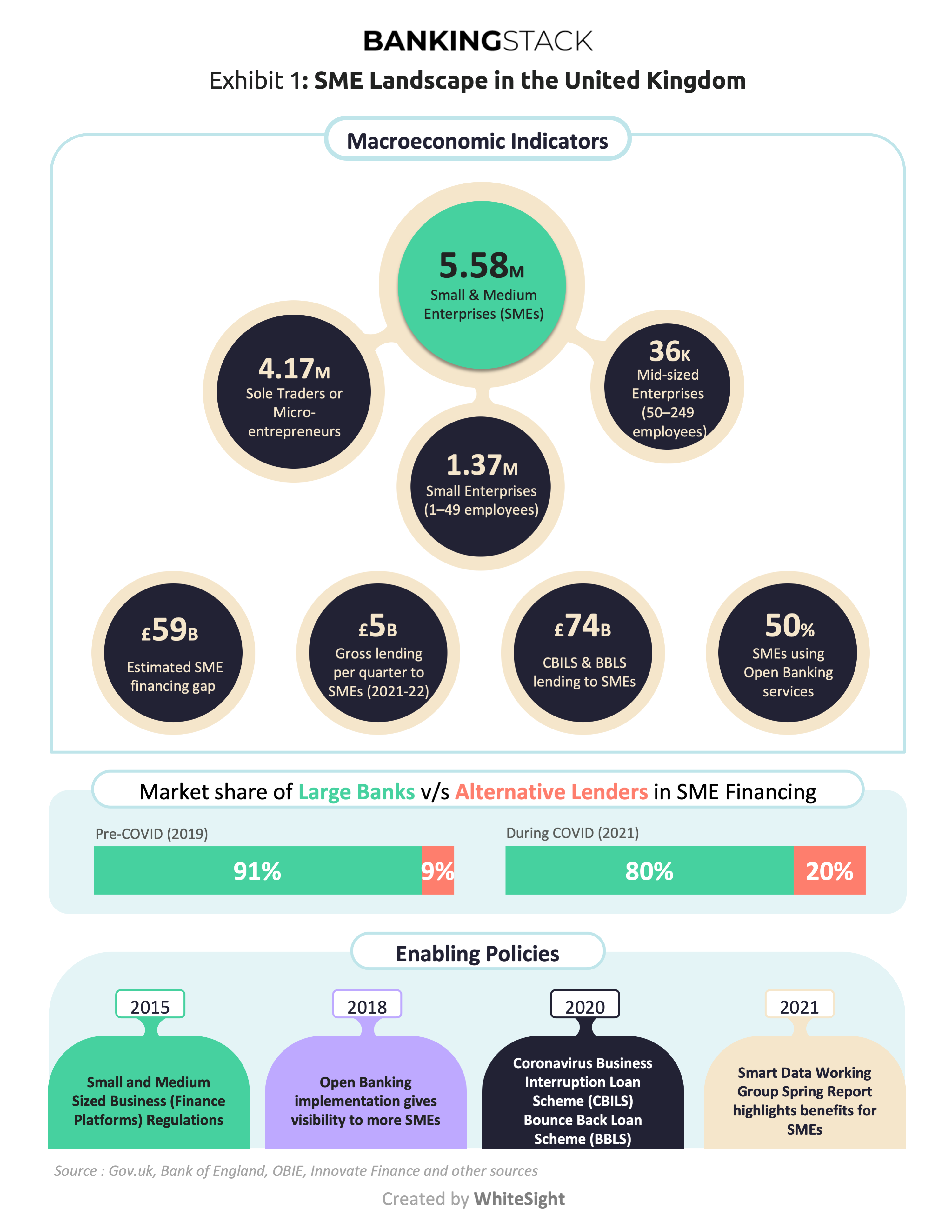

Alternative lenders have targeted underserved niche businesses to lead the ‘unbundling’ of SME financing across the value chain and industry verticals (Exhibit 2). The ancillary providers play an important role in enabling the open data network that alternative lenders use. The enabling trends for SMEs act as tailwinds for solution providers and SME adoption.

Unbundling financing options across supply, operations, and sales makes sense considering the differences in the ticket size, duration and risk validating data points for each. When viewed from this lens, each link in the SME value chain offers opportunities to innovate targeted lending products. Importantly, this forms an organic approach to identifying opportunities to embed financing products at point of need.

- Supply Chain Financing

Fintechs like Muse, Finverity, Sonovate, Hokodo and Tranch are addressing the vendor or supplier payments space with solutions like Purchase order financing, procurement financing, invoice discounting, and B2B buy now, pay later (BNPL). While most of these products exist in the market, fintechs are making them a lot more accessible to SMEs and significantly reducing the rejection rates.

- Sales Based Financing

On the sales and distribution front, multiple financing options are available for SMEs catering to different needs. Providers like Uncapped, Vitt, Liberis, and Outfund use proprietary algorithms and multiple real-time data points to enable revenue-based financing, while big techs like Amazon and PayPal offer unsecured financing for e-commerce sellers.

- Operations Financing

When it comes to sustaining business operations across functions such as employee payroll, employee spend management, working capital, and business capital, the needs of SMEs can vary depending on the nature of their business. In such instances, specialist solution providers offer small businesses targeted products. Companies like Soldo, Ben, and Expend provide physical and virtual cards for spend management and offer various value-add services to businesses. Hastee and Karma have built solutions to improve employees’ financial health by providing on-demand access to earned income and salary advance loans. Iwoca, Funding Xchange, and Outfund also offer various forms of unsecured business loans to SMEs looking for alternatives to collateral-backed loans.

Rebooting the Credit Risk Engine

Access to high-fidelity alternative data from public databases and enterprise digital platforms, and financial automation are transforming the speed and efficiency with which credit risk can be assessed. Banks can now:

- Perform fully digital eligibility checks for requested credit products, reducing cost and turnaround time significantly for both, banks and businesses

- Run automated models to identify business-specific credit limits and repayment tenures across different product types; this significantly enhances a bank’s potential to recommend and cross-sell across a diverse portfolio of lending products

- Simulate price elasticity of demand for risk-based pricing and negotiation

- Leverage flow-based underwriting models for creditworthiness, overriding some of of strongest barriers to moving beyond collateral-backed financing

- Assess behavioural and commercial patterns for risk and fraud indicators

- Analyse cash-flow situations for affinity and urgency indicators

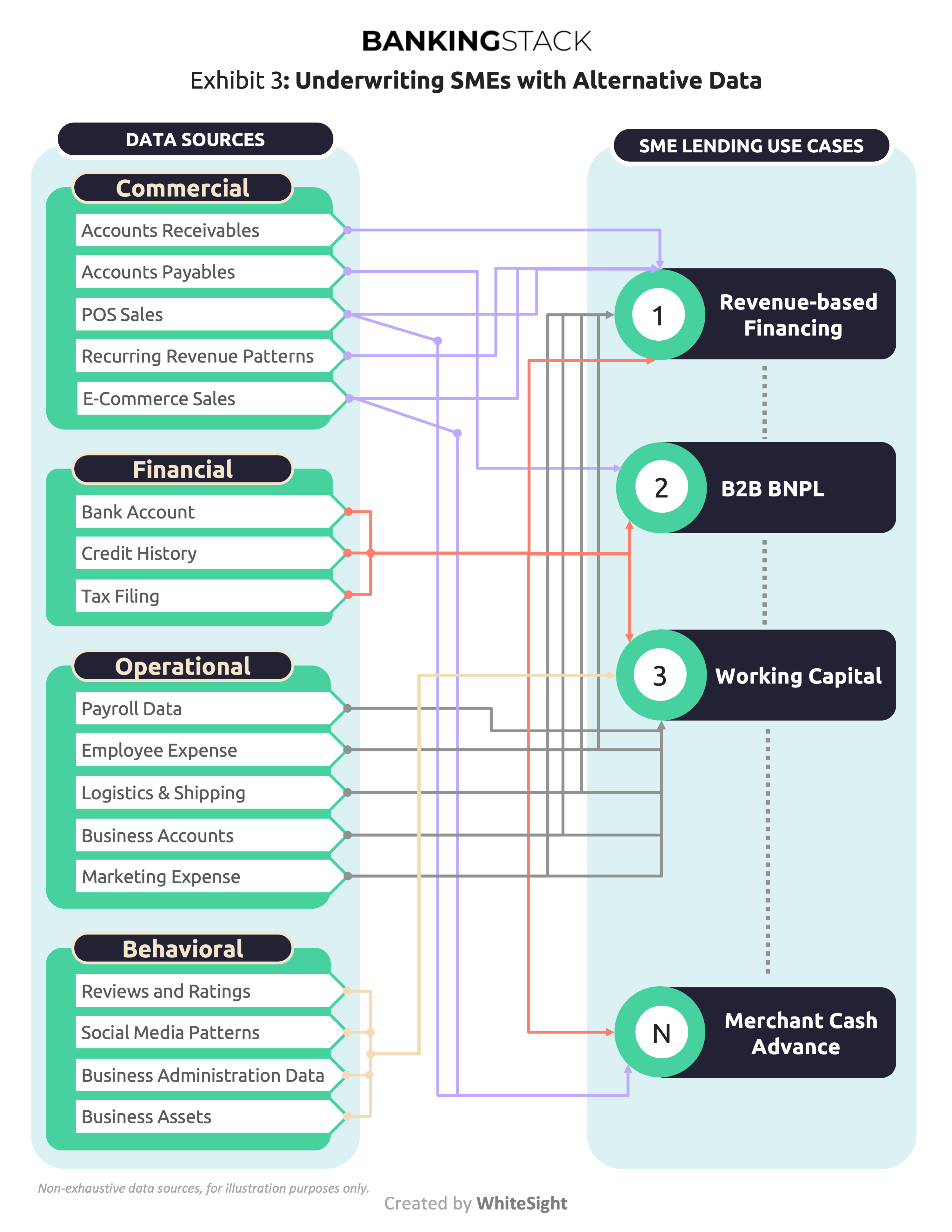

Exhibit 3 illustrates some of these digital data sources and how they can help banks innovate credit products to contextually serve SMEs across business and revenue models.

Let’s look at how these data sources enable some alternative lending products:

- Revenue-based financing (RBF): RBF is emerging as a popular credit product amongst thin-filed businesses with recurring revenue streams, such as SaaS enterprises and D2C subscription firms.

For RBF underwriting, datasets such as invoicing data, account receivables data, and payment gateway data help banks assess current recurring revenue streams and analyse historical patterns. Alternative datasets from digital marketing platforms, commerce or marketplace platforms allow lenders to evaluate expected revenue growth, revenue stability, and expense margins which are critical for flow-based underwriting.

- B2B BNPL: B2B Buy Now, Pay Later is a form of short-term financing offered to business buyers at the point of sale. Traditionally lenders have extended trade credit to bigger business buyers for high-value asset purchases through asset-based financing. B2B BNPL is a more immediate and embedded option, offered at point of payment for a variety of commercial purchases.

For B2B BNPL underwriting, along with business credit scores to support prospecting and KYB activities, lenders also depend on direct access to business data like aggregated balances, sales, purchase orders, inventory, receivables, payables, payment history, order delivery status, etc.

- Unsecured Working Capital: Access to cash flow data from commercial platforms such as invoicing, payment processing, and accounting platforms helps banks assess the creditworthiness and affordability of business borrowers to offer unsecured credit for working capital.

Access to operational expense data from operational platforms such as payroll, expense management, logistics, and digital marketing platforms allows lenders to granularly verify the capital requirements for working capital and assess risk and fraud indicators for the business. Additionally, behavioural datasets such as social media engagement data, customer reviews and ratings, etc., provide additional cushion for lenders to offer extended credit to businesses showing signs of promising growth.

- Merchant Cash Advance (MCA): MCA involves providing cash advances to small businesses based largely on transaction data from small businesses’ payment gateways for online sales and/or PoS terminals for in-store sales. The advance is repaid as a percentage of future card sales.

Underwriting for MCA is enabled through accessing commercial data platforms such as e-commerce, payment gateways, and PoS terminals. The ability of lenders to assess credit risk can be improved further by expanding access to expense data from operational platforms such as payroll, expense management, accounting, and marketing platforms.

A Call for Innovation in SME Lending

The evolution in SME business models has increased the barriers to access financing from traditional lenders. A growing number of SMEs are asset-light and fast-growth enterprises that are not able to meet traditional thresholds of collateral or profitability. SMEs are also experimenting with newer revenue models, while existing revenue models are seeing greater fluctuations based on macro conditions.

The digital technology layer that helps banks to plug into SME business data is an essential building block for lending innovation. Adopting this opens up near-endless possibilities for banks to develop targeted, segment-specific lending products. Specifically, a business-data-led and unbundled approach to alternative lending will help banks innovate around some of the most entrenched challenges in SME lending:

- Underwriting of unsecured loans: The effort-to-value ratio for SME loan sizes has been a major friction point for banks as well as businesses. SMEs find it daunting or impossible to put up high value collateral even for smaller loan sizes, whereas banks find it inefficient to execute such extensive risk assessments for small loans. Adopting automated risk assessment models based on accurate, current business data can help banks scale their unsecured lending portfolios in a risk-free manner.

- Collateralisation of cash flows: While historical cash flows have been used as proof of business credibility, lenders have often overlooked the value of present and future cash flows as a means to granularly and accurately assess the business stability and future growth potential of SMEs. Doing this can enable lenders to introduce more innovative financing offerings such as revenue-based financing and merchant cash advance and expand the target addressable market significantly.

- Flexible repayments: SME businesses are particularly vulnerable to fluctuations in revenue, whether based on seasonal, cyclical or macroeconomic factors, leading to high rejection rates. Financial automation capabilities can help banks innovate repayment models to accommodate this vulnerability, while ensuring adaptive and ongoing risk monitoring to flag any potential long term impact.

Conclusion

Digital adoption by SMEs has opened up a host of new possibilities in lending. Currently, fintechs are leading the charge by innovating and proving the use cases for unbundled, alternative lending solutions. While the long-term advantage in this highly regulated product space belongs to traditional lenders, they need to bridge the gap in leveraging SMEs’ digital data ecosystem and adapt their underwriting models to regain the lead.

References:

- https://home.barclays/news/press-releases/2022/08/smes-report-revenue-growth-but-brace-themselves-for-turbulent-ti/

- https://www.legislation.gov.uk/ukpga/2012/21/contents/enacted

- https://www.openbanking.org.uk/news/adapting-to-survive-uks-small-businesses-leverage-open-banking-as-part-of-their-covid-19-crisis-recovery/

- https://www.gov.uk/government/groups/smart-data-working-group

- https://www.british-business-bank.co.uk/finance-referral-platforms-policy/

- https://bcr-ltd.com/cif/

- https://www.innovatefinance.com/news/alternative-lenders-delivered-for-small-businesses-during-covid/