After all the excitement generated by B2C point of sale payment flows, the focus of fintech innovation is firmly shifting to B2B payments now. Expected to exceed USD 200 trillion in volumes by 2028, B2B payments are seeing focused efforts to solve deeply entrenched inefficiencies like manual processing, high costs, limited transaction visibility and payment delays. As businesses increase their use of electronic payments, fintech innovation is taking B2B payments towards a ‘checkout’ experience similar to B2C payments, with focus on automated, fast and frictionless transactions for the buyer and seller.

Players like payments service providers, card networks, merchant platforms and financial automation providers are digitising different parts of the value chain, addressing accounts payable – accounts receivables (AP-AR) automation, cash flow management, integration of payments into ERP systems and more. The coming together of these solutions into a cohesive B2B payments experience is especially relevant for small and medium enterprises (SMEs) as it can unlock value for them in three significant ways:

- Access to financial automation features that can cut costs by 75% and unlock USD 1.5 trillion in productivity benefits

- Ability to accept payouts in a variety of payment modes, increasing their chances of being paid faster and with less friction

- Access credit and liquidity management solutions embedded in the payments flow, addressing the longstanding working capital credit gap

The third aspect, embedding of credit at B2B point of sale (POS), especially for the mid-market segment, has been seeing a lot of traction. Fintechs focused on solving B2B payments have made steady progress over the past few years, using transactional data and alternative risk-assessment to deliver transaction or PoS-based lending to underserved SMEs.

The global commercial lending market is expected to grow at over 15% CAGR, yielding up to USD 27 trillion between 2021 to 2028. SMEs will account for USD 13 trillion of the revenues. For banks, B2B POS-based lending offers a low-risk approach to scale SME lending while capturing the mid-market commercial lending segment.

How can B2B Payments Enable POS-based Lending?

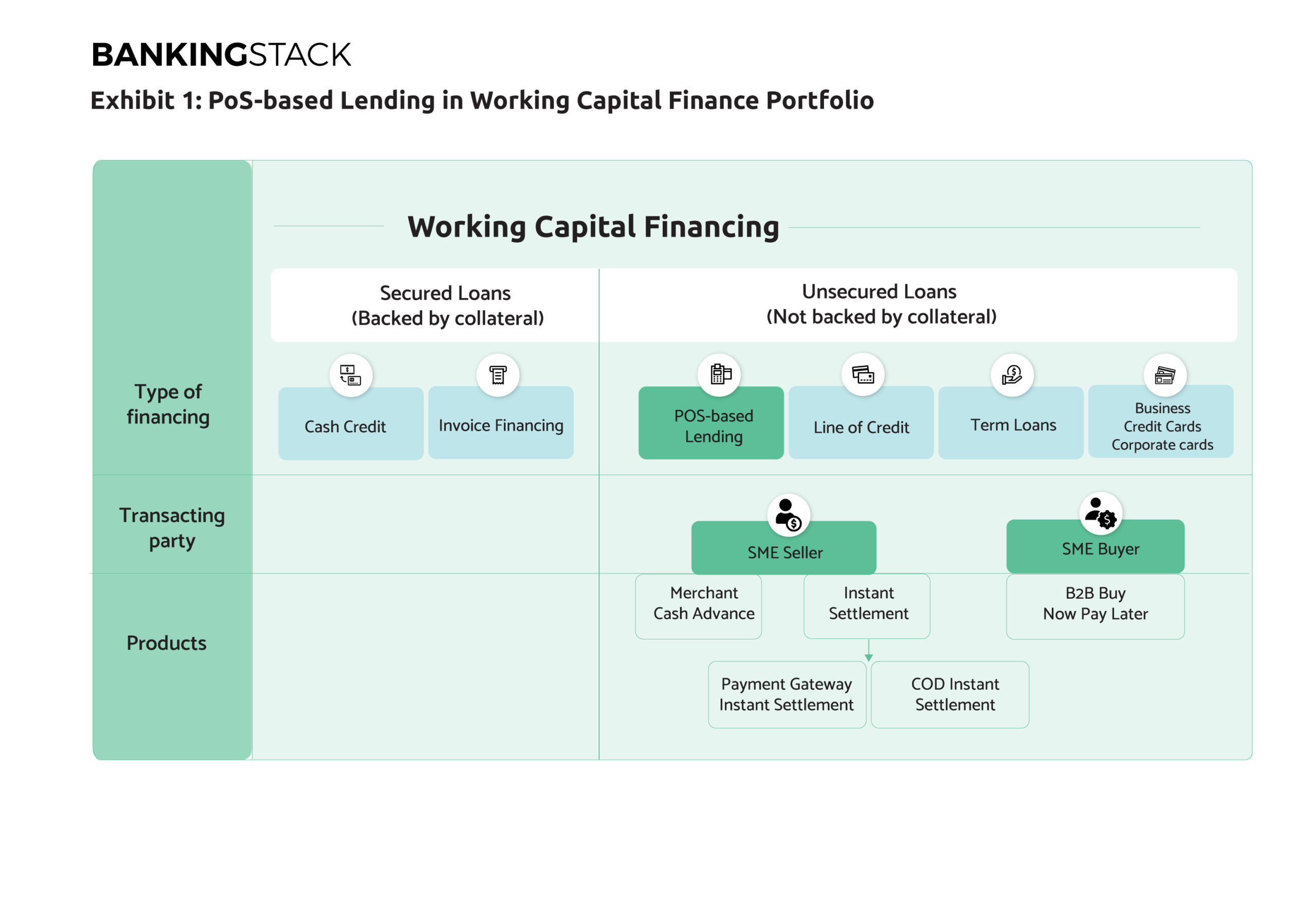

Apart from asset-backed or secured lending products, banks issue unsecured working capital credit in the form of credit lines or corporate credit cards. These loans are issued based on assessment of traditional business data around profitability, balance sheet and credit history. This precludes credit access to businesses that are new to credit, thin-filed, or not yet profitable despite having steady revenues.

With B2B POS-based lending, banks can embed financing options like buy now pay later (BNPL), or early/instant settlement at the point of payment. Digital B2B payments create a parallel pool of sales and transactions data, which can be leveraged to offer POS-based financing solutions. Automated risk assessment drives credit decisions based on real-time access to transactional data available across the value chain (banks, payment intermediaries, AR-AP systems (ERP)):

- Invoices of merchants, both raised and due (B2B) and their supply chain

- Cash-flow position in integrated accounts

- Retail sales

- In-process payment settlements

- History and status of credit availed, including repayments and defaults

- Performance of merchant products and/or services and their distribution

For example, AMEX recently launched a digital B2B payments ecosystem platform or marketplace called Business LinkTM, where network issuing and acquiring participants can offer B2B credit solutions to their buyers and suppliers. Also, Visa Direct’s feature for SMB Payouts enables real-time settlement of funds for small and medium businesses.

From a bank’s perspective, B2B POS-based lending would be a part of their working capital credit portfolio, aligned with other unsecured forms of lending (Exhibit 1). The lending products can be classified based on whether the borrower is the buyer or the seller.

Adoption Strategies

Banks are already participating in the B2B POS-based lending market through distribution strategies with payment service providers or merchant platforms functioning as channels to originate loans. While this has helped banks enter the market with minimal investments, their access to the SMEs is limited and indirect.

The other approaches involve ‘building’ or ‘buying’ technology platforms with payments and POS-financing capabilities. Either of these approaches can help banks enhance engagement and monetisation of their existing business banking relationships, while presenting a competitive value proposition for new-to-bank SMEs. Agility of adoption, ease of integration with existing infrastructure and workflows, and capex emerge as some of the critical decision-points for banks when making this decision.

Cloud-native SaaS platforms like BANKINGSTACK are emerging as an alternative to on-premise infrastructure-led technology solutions. Delivering an integrated financial OS that spans accounting and book-keeping, invoicing, taxation, payments and collections capabilities, BANKINGSTACK can help banks offer an end-to-end business finance management environment, with seamless journeys between banking and beyond banking capabilities. The OS includes a multi-modal payments experience, allowing merchants to accept payments across modes like net banking, credit/debit cards and UPI.

With pre-built alternative underwriting capabilities embedded within these financial flows, BANKINGSTACK allows banks to offer the right credit offering to the right business at the right time.

To know how we can help, book a demo, or write to us at: letstalk@bankingstack.com.

References:

- Goldman Sachs; B2B: How the next payments frontier will unleash small business; https://www.gspublishing.com/content/research/en/reports/2019/09/04/201b4777-6217-4638-9701-fb98d67d9d5d.pdf

- Research Dive; https://www.globenewswire.com/en/news-release/2022/04/25/2428250/0/en/Global-Commercial-Lending-Market-Anticipated-to-Generate-a-Revenue-of-27-406-6-Billion-and-Rise-at-a-CAGR-of-14-4-during-the-Forecast-Timeframe-from-2021-to-2028-190-Pages-Reveals-.html

- American Express; https://about.americanexpress.com/newsroom/press-releases/news-details/2022/American-Express-Launches-Amex-Business-Link-a-New-Digital-B2B-Payments-Ecosystem-for-Network-Participants/default.aspx