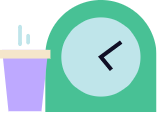

B2B e-commerce, a key driver for embedded supply chain finance solutions like B2B BNPL, is over 5 times the volume of B2C e-commerce, and is expected to touch USD 25.65 trillion globally by 2028.

Fintech-enabled B2B buy-now-pay-later (BNPL) has been gaining in attention significantly since last year. Nothing like its consumer-focused counterpart, and not really a new product in itself, B2B BNPL is finding traction as it solves the critical problem of access to supply chain finance, especially for small and medium businesses (SMBs). Embedded within the payments experience, B2B BNPL is collateral-free, short-term credit, which allows sellers to access payments immediately, while allowing buyers to improve their inventory turnover ratios. Repayment terms being offered by fintech platforms vary vastly across industries, ranging from a fortnight to a year, based on convention. But the key innovation underlying B2B BNPL is the seamless, completely digital credit-risk assessment model that makes all of this possible.

Widening trade finance gap is one of the major factors driving focus to B2B BNPL. The global trade finance gap reached USD 1.7 trillion in 20201, representing 10% of the total global trade volume. This is an especially prominent issue for the micro, small, and medium-size enterprises (MSMEs), as the financing rejection rates for MSMEs stands at 40%, with a 2017 World Bank study stating that about 65 million such businesses are credit constrained2. Given the fact that MSMEs are playing an increasingly important role in overall global trade, these numbers are a strong indicator of the need for alternative and digitally-delivered supply chain finance solutions.

The accelerated growth in global B2B e-commerce is a strong tailwind for B2B BNPL, with the market size being valued at USD 6.9 trillion in 20213. The sector is expected to expand at a CAGR of 18.7%, between 2022 and 2028, touching USD 25.65 trillion by 2028. Rapid adoption of digital tools by SMBs is another strong enabler. According to OECD, global business surveys highlight the fact that nearly 70% of SMBs have accelerated their use of digital technologies post COVID4. The digitisation of SMB business data has helped fintechs roll out alternative credit-assessment models that work based on access to buyers’ previous purchases, vintage payments history, cash flow, etc.

As depicted in Exhibit 1, there are several contributing factors highlighting the growing B2B BNPL opportunity globally. And currently, this entire opportunity is owned by fintechs. While banks have traditionally offered supply chain finance products, the kind of credit decisioning and embedded experience required by B2B BNPL is not a native capability for banks yet. Different McKinsey reports mention that, as of last year, fintechs have managed to pull away annual revenues worth USD 8 to 10 billion from traditional lenders5, controlling about 10-15% of the supply chain finance (SCF) market6.

In this article, we understand why B2B BNPL succeeds as a product, and what are some of the moves banks are making globally to step into this market.

The Case for Buy Now Pay Later for Businesses

According to a recent Barclays report, 3 out of 5 SMBs currently face late payments on their invoices, leading to cash constraints and major issues in the underlying cash flow7. Studies further indicate that almost 50% of SMBs end up failing within just the first five years of inception due to cash flow challenges. The Association of British Recovery Professionals stated that “over a fifth of corporate insolvency is the result of delayed payments for goods and services.”8

Several experts have evaluated why traditional supply chain finance (SCF) solutions are unable to address this challenge of access and risk assessment when it comes to SMBs9. For one, a large number of SCF providers are still focused on larger corporates and recurring, big ticket purchases. This precludes smaller, less well-financed companies attempting to access such solutions.

Most SCF solutions are yet to implement innovations like APIs, which could open up access to buyer data and thus enable better risk-assessments. This is an important step that can help make financing options cheaper and more accessible. With traditional risk assessment, in many scenarios, less than 50% of the total spend is actually eligible for financing, with the actual uptake being just 60-70% of this amount.

Another aspect is that only a few banking and non-banking financial entities currently possess comprehensive SCF expertise and access to in-house processes. This, in turn, restricts access to supply chain finance for businesses that have accounts in these institutions.

Fintechs have understood these challenges and focused on solving both, access and better credit-risk assessment for businesses by:

- Embedding access to financing options at the point of purchase; for example, US-based Resolve, a B2B spin-off from consumer BNPL provider Affirm, allows merchants to embed ‘net terms invoicing’, a buy-now-pay-later option as part of their check-out process. Buyers choosing to use the option are redirected to the Resolve portal for onboarding or signing in. Resolve assures a ‘quiet credit check’ of the buyers’ creditworthiness within hours.

- Harnessing fintech solutions such as account aggregation, e-tax and e-invoicing to resolve complexities around onboarding, underwriting and payments; Berlin-based Billie offers B2B buyers BNPL options for all their business-related expenses. Buyers can create a profile on the Billie Buyers’ portal for free and track all their expenses and payments from there. When checking out their purchases at any merchant site that offers the Billie BNPL option, buyers can check-out with real-time customer verification.

- Automated and on-going credit decisioning based on access to the buyers’ business and financial data, credit history, payments history, and more; European B2B BNPL provider Hokodo performs a real-time credit and fraud check while the buyers are shopping on the merchant platform. At the time of check-out, buyers are presented with only those options that they qualify for.

Another major benefit of B2B BNPL is enabling thin-filled SMBs to create better credit profiles, as long as they make timely BNPL repayments.

Transforming Banks’ Traditional Lending Models with B2B BNPL

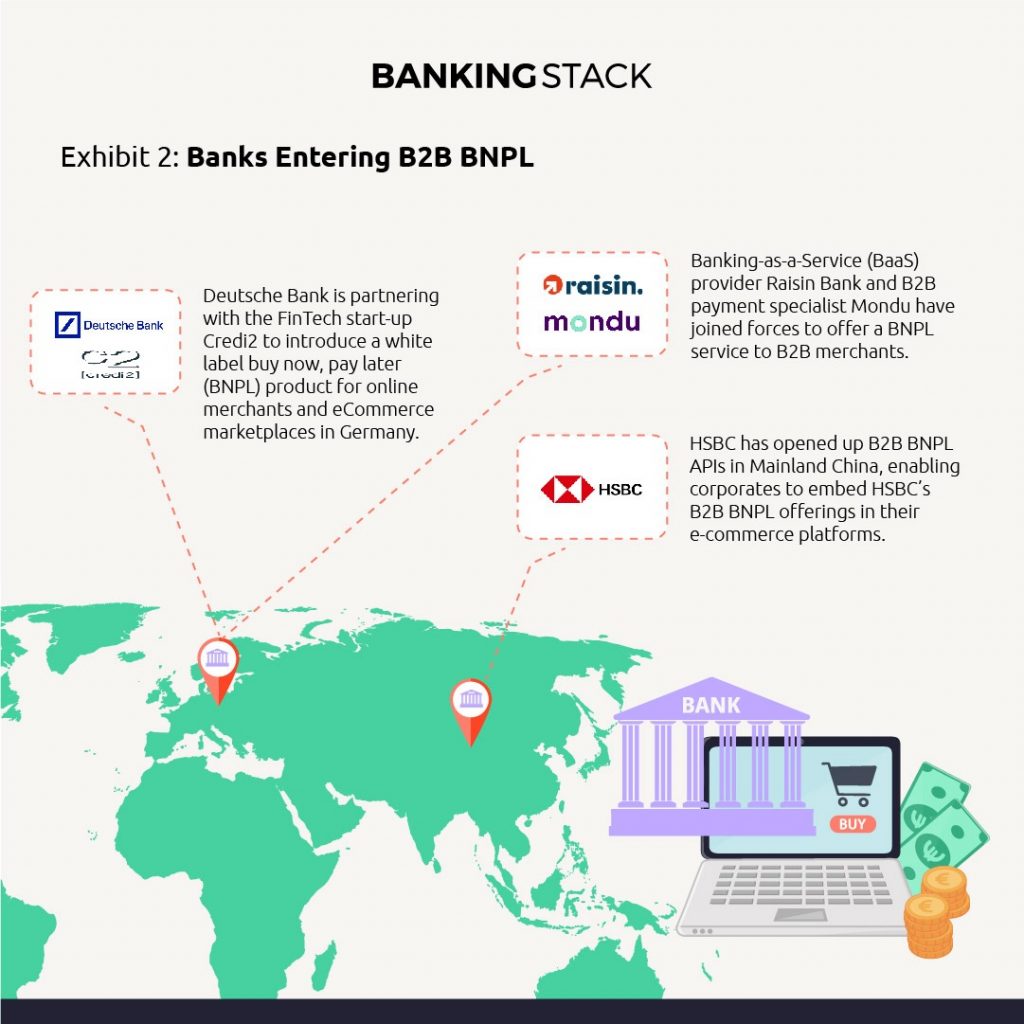

Traditional lenders have natural advantages of access to low cost capital and the necessary regulatory infrastructure in place when it comes to supply chain finance. Adaptive institutions have taken note of the B2B BNPL disruption, and several global banks have entered into partnerships with fintechs or launched their own solutions for this space (Exhibit 2).

Deutsche Bank is associating with fintech Credi2 with the aim of launching a white label BNPL product for online merchants and ecommerce marketplaces in Germany10. Separately, Raisin Bank, known for its Banking-as-a-Service (BaaS) solutions, is collaborating with B2B payments major Mondu to provide focused BNPL solutions to B2B merchants11, while HSBC has opened up its B2B BNPL APIs in Mainland China. The APIs are now enabling companies to embed the lender’s B2B BNPL offerings on their e-commerce platforms12, making credit access faster and more seamless.

The BANKINGSTACK OS can help banks adopt B2B BNPL capabilities in two models:

- as a point of payment option embedded in the buyer’s digital bank account, and

- as a purchase invoice financing option, available to suppliers keen on accessing immediate payments on purchase orders

In both these cases, it is the underlying credit assessment model that acts as the key enabler. Compared to traditional risk assessment models, the BANKINGSTACK credit engine can deliver the following capabilities to banks:

- Automated credit assessment with minimal to no documentation requirements. Credit assessment depends largely on direct access to business data like aggregated balances, sales, purchase orders, inventory, receivables, payables, payment history, order delivery status, etc.

- More robust credit assessment as compared to the traditional model, as the engine monitors a larger number of variables and can perform ongoing assessments on how and when the buyer’s repayment ability will be impacted.

- Adaptive credit assessment, with changing trends in business performance or stability, reflected as changes in credit limits or repayment terms offered to buyers. This makes it more optimised than the traditional and reactive credit assessment models.

- Application of usage-based charges, as seen in credit cards, helping businesses process more orders, increasing inventory turnover, while controlling financing costs overall.

A B2B pharma marketplace for manufacturers, distributors and retailers recently partnered with a leading Indian bank to embed our B2B BNPL solution on their platform. Using this solution, retailers get access to collateral free credit basis their cash flow, as well as exclusive benefits from distributors on the platform. These can include access to interest-free credit on 15-day billing periods, as well as low interest rates for longer durations.

By enabling such use cases for corporate banking customers, banks can embed themselves into the heart of the customers’ trade, significantly enhancing their overall lending play. B2B BNPL also helps banks access high-growth but thin-filed businesses in a low-risk context. Finally, data shows that B2B BNPL has had exponential growth impact for merchants, delivering several multiples improvement in conversions and order volumes. Becoming the key driver for this growth positions banks in a very advantageous position in an increasingly fragmented market.

References:

- https://www.adb.org/news/global-trade-finance-gap-widened-17-trillion-2020

- https://www.mckinsey.com/industries/financial-services/our-insights/reconceiving-the-global-trade-finance-ecosystem

- https://www.businesswire.com/news/home/20211203005471/en/The-Global-B2B-E-Commerce-Market-Size-is-Estimated-to-Reach-USD-25.65-Trillion-Expanding-at-a-CAGR-of-18.7-from-2021-to-2028.—ResearchAndMarkets.com

- https://www.oecd.org/industry/smes/PH-SME-Digitalisation-final.pdf

- https://www.mckinsey.com/industries/financial-services/our-insights/buy-now-pay-later-five-business-models-to-compete

- https://www.prove.com/blog/how-fintech-modernizes-sme-supply-chain

- https://home.barclays/news/press-releases/2022/01/three-in-five-uk-businesses-are-owed-money-from-late-payments–f/

- https://www.prove.com/blog/how-fintech-modernizes-sme-supply-chain

- https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/accelerating%20winds%20of%20change%20in%20global%20payments/chapter-3-supply-chain-finance-a-case-of-convergent-evolution.pdf

- https://www.pymnts.com/bnpl/2022/deutsche-bank-partners-with-credi2-to-pilot-white-label-bnpl-product/

- https://www.pymnts.com/news/b2b-payments/2022/today-in-b2b-raisin-bank-teams-mondu-bnpl-tool-small-businesses-need-ecommerce-insurance/

- https://develop.hsbc.com/api-overview/trade-finance-b2b-buy-now-pay-later