With traditional risk assessment, less than 50% of business spends of SMEs are eligible for financing[1]. The shift from asset-backed financing to cash flow or transaction-based financing is helping unlock the underserved SME lending market. While banks are accessing this market through distribution partnerships with fintechs, the potential to own and monetise the merchant relationship is very limited.

As of last year, fintechs have managed to pull away annual revenues worth USD 8 to 10 billion from traditional lenders[2], and control about 10-15% of the supply chain finance (SCF) market[3].

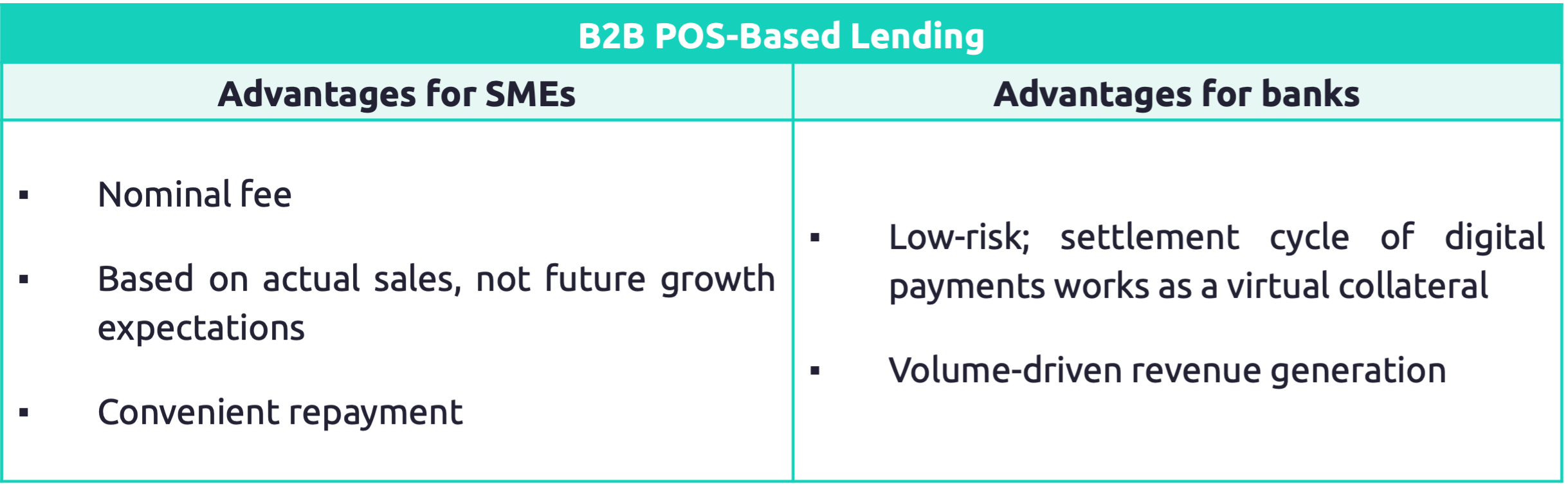

In our previous post, we spoke about how the B2B payments experience – and a unified point-of- sale (POS) solution – is more than just a payments opportunity for banks. Using the point of sale to drive B2B PoS-based lending is emerging as a liquidity management tool for SMEs, and is beneficial for both, SMEs and lenders.

Three B2B POS-based Lending Use Cases for Banks

-

Payment Gateway Instant Settlement (PGIS) at Point of Sale

Payment settlement cycles for digital transactions range from 2 to 7 days, depending on the mode of payment. With an increase in digital transactions, an increasing share of merchants’ capital is caught in transit. A Deloitte study found that SMEs may keep between 4–7% of their annual sales as cash contingency to cover for the time it takes business payments to reach their accounts[4]. Instant settlement provides easy and early access to money, helping SMEs improve their ability to take more orders, pay vendors or utility bills/salaries, and save additional interest to creditors.

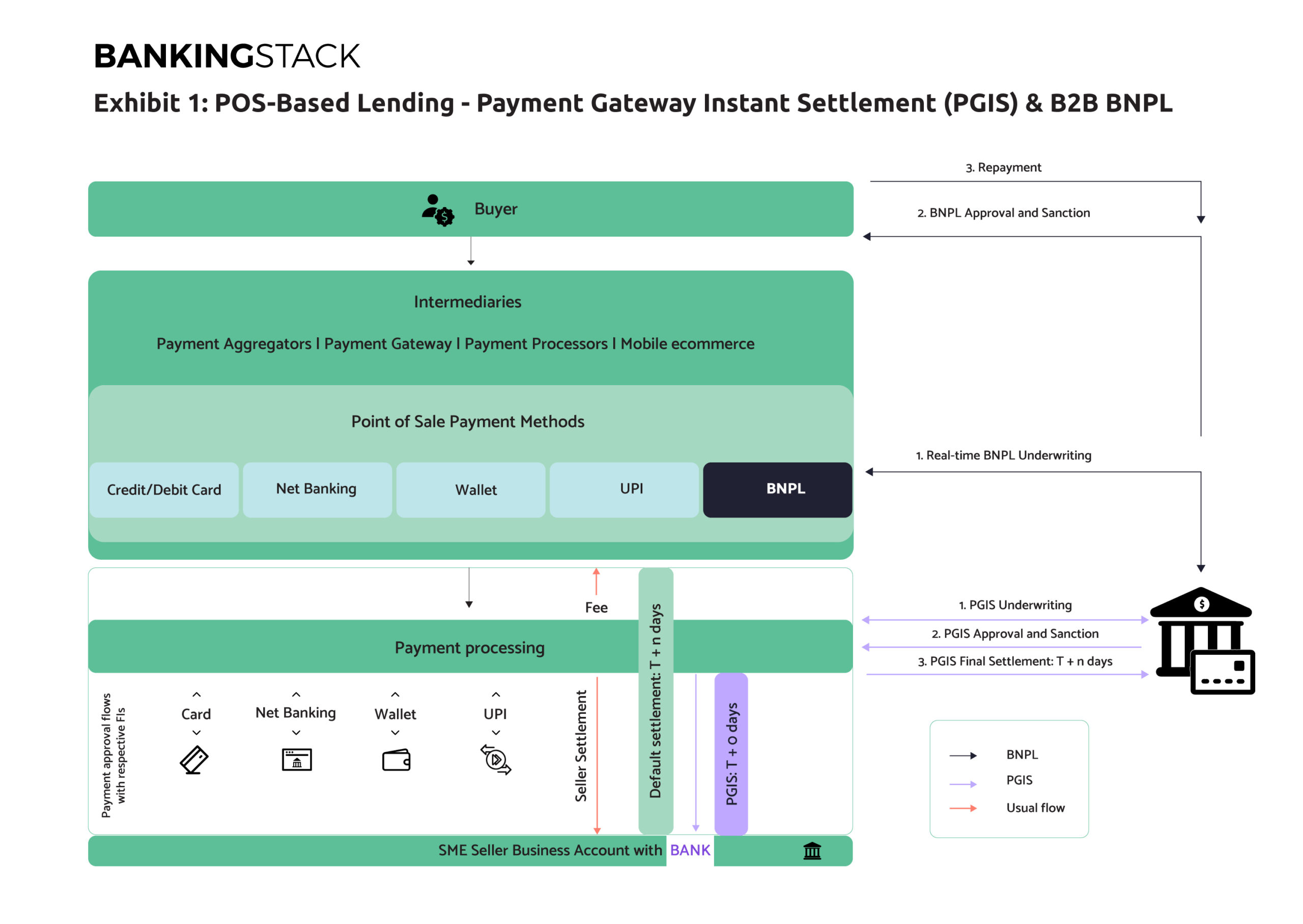

Today, most payment intermediaries (aggregators, gateways, processors and merchant platforms) offer instant settlement to merchants instead of regular batch settlement of ‘T + n’ days. In most cases, financing or credit is provided by a partner non-banking financial institution.

Banks have greater direct visibility into the transactional footprint as the intermediary nodal account and SME current account can sit with them. They are thus well-positioned to offer PoS-based credit as instant settlement directly to their SME customers. Exhibit 2 presents a workflow illustrating how PGIS would work with a bank functioning as the lender.

Some characteristics of PGIS:

- Current PGIS offerings in the market allow merchants to choose from three frequencies for settlement: real-time, same-day or on-demand

- The return on PGIS is set at a nominal fee, usually an additional charge of 0.2% to 0.8% on top of MDR, which is deducted from merchant’s settlement balance.

- Intermediaries who mostly borrow from non-banking financial institutions to deliver early settlements, pay an annual percentage rate in range of 18% to 24% for the funds, depending on the transaction volumes and profile.

- Refunds and chargebacks are handled via separate virtual accounts, where merchants are expected to keep reserve funds themselves.

- Merchants can choose between several options for receiving settlement funds. In India, for example, Bank Account, Virtual Account Number, native wallets and Virtual Payment Address (UPI) are offered as settlement destinations by payment gateway providers and IMPS, UPI, NEFT or RTGS as money transfer rails. This offers lenders low-risk exposure as it gives complete visibility to merchant transactions, payment gateway data and reconciliation cycle.

-

Cash on Delivery Instant Settlement (CODIS)

The Cash on Delivery payment mode is the most challenging one for merchants. At the same time, in several markets like India, COD is a preferred mode of payment for more than 65% of buyers. This is especially true of Direct-to-Consumer (D2C) brands, which need to establish trust with customers and hence need to offer COD as an option.

The delivery cycle adds an additional data and money loop in the case of COD. Since delivery partners and logistics service providers aren’t regulated for payment settlement timelines, there is usually a delay of 7-10 days in depositing collected payment in logistics provider or e-commerce provider account.

Given the longer working capital lock-in, instant settlement for CoD payments is a hot need for merchants. The transaction data for CoD transactions stays available with the payment service provider as the transaction is initiated on its platform. Status of collected payments is also reconciled with payment platforms and online settlement cycle is well known. This data can be utilised to assess the transaction-based financing eligibility of the merchant and short-term line of credit.

-

B2B Buy Now Pay Later (BNPL)

Embedded within the payments experience, B2B BNPL is collateral-free, short-term credit, which allows sellers to access payments immediately, while allowing buyers to improve their inventory turnover ratios. Driven by automated credit decisioning and embedded experience, the B2B BNPL opportunity is currently owned entirely by fintechs.

Read our earlier blog for more details on the B2B BNPL opportunity, driven by the USD 25.65 trillion global B2B e-commerce segment (2028 expected size).

Exhibit 1 presents a high level flow of data and money between the bank, payment gateway and the buyer in the case of PGIS and B2B BNPL.

How to Enable B2B POS-based Lending

Compared to the more traditional forms of lending, B2B POS-based lending allows banks to scale lending to new to credit or new to bank SMEs cost-effectively, while controlling risk exposure. Let’s look at the capability set banks need to be able to deliver this form of credit to their business banking customers:

- Digital Onboarding: SMEs onboarded through digital-only channels, with minimal to no documentation requirements. Automated data validation within 24 hours or less through APIs with the business’ finance and accounting, ERP (AP/AR), e-commerce and digital marketing tools.

- B2B Checkout Experience: A multi-modal payment gateway embedded seamlessly in the merchant’s order-to-cash flow. Hosting the merchant’s entire business finance management experience within the native banking channel is the best model to ensure seamless, cost-effective and real-time delivery of POS-based lending.

- Credit Decisioning: Automated risk assessment using direct access to business data like aggregated balances, sales, purchase orders, inventory, receivables, payables, payment history, order delivery status, etc. Credit scoring capabilities based on alternate data with enhanced fraud and risk assessment engines. Partnerships with data aggregators and account information service providers across credit history, tax returns, utility payments, etc.

- Delivery and Repayment: Automated workflows to calculate and deliver settlement amounts net of interest/fee. Flexible repayment options like booked sales, near future payments, or zero interest EMI schemes. Banks should also look at potential to control where the spend happens by way of offering APIs to SMEs to build micro-transactions, wish-lists and shopping carts.

To know how we can help, book a demo, or write to us at: letstalk@bankingstack.com.

References:

[1] https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/accelerating%20winds%20of%20change%20in%20global%20payments/chapter-3-supply-chain-finance-a-case-of-convergent-evolution.pdf

[2] https://www.mckinsey.com/industries/financial-services/our-insights/buy-now-pay-later-five-business-models-to-compete

[3] https://www.prove.com/blog/how-fintech-modernizes-sme-supply-chain

[4] https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/financial-services/deloitte-uk-economic-impact-of-real-time-payments-report-vocalink-mastercard-april-2019.pdf